by Robin Scrace | Feb 14, 2022 | Community, Internal Revenue Service, Tax

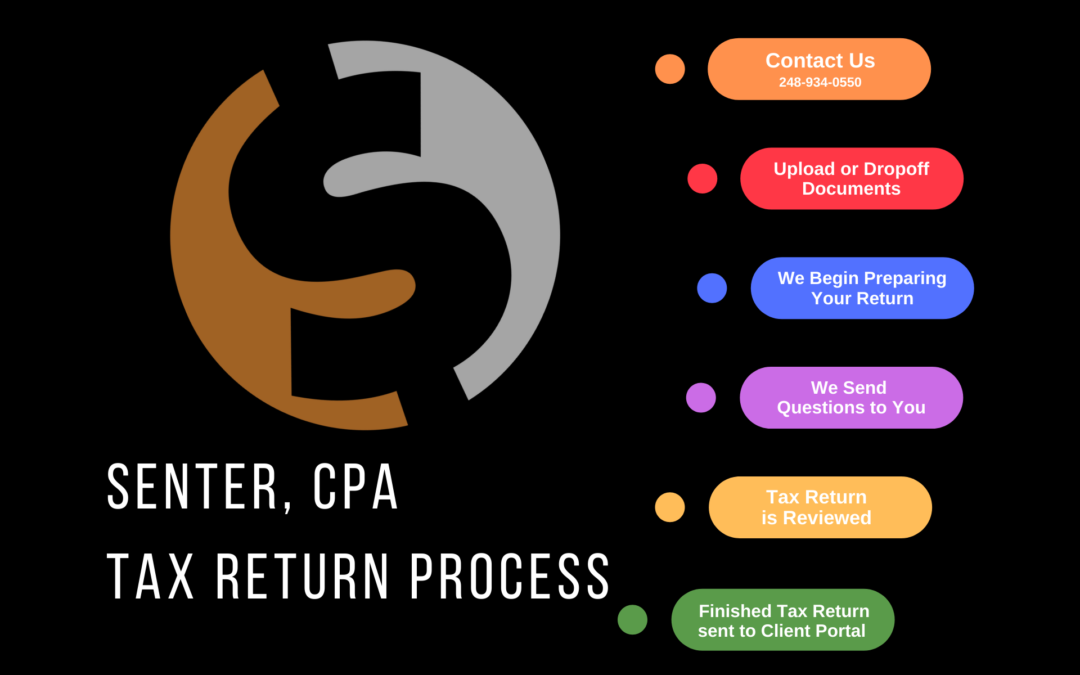

How Our Process Works Step 1: Contact Us Telephone: 248-934-0550 Use our online contact Form: HERE (or use the contact form below) Step 2: Upload Your Documents to Our Secure Portal A meeting isn’t required for us to prepare you taxes. Once you decide that...

by Matthew Senter | Dec 28, 2021 | Community, Team

What a Year It Has Been! … I think we say that every year. I think we all had hoped COIVD would be a term we’d no longer be using, but unfortunately, that just wasn’t the case. Although it’s still prevalent, and while there has been a lot of bad news...

by Matthew Senter | Nov 16, 2021 | Internal Revenue Service, Tax

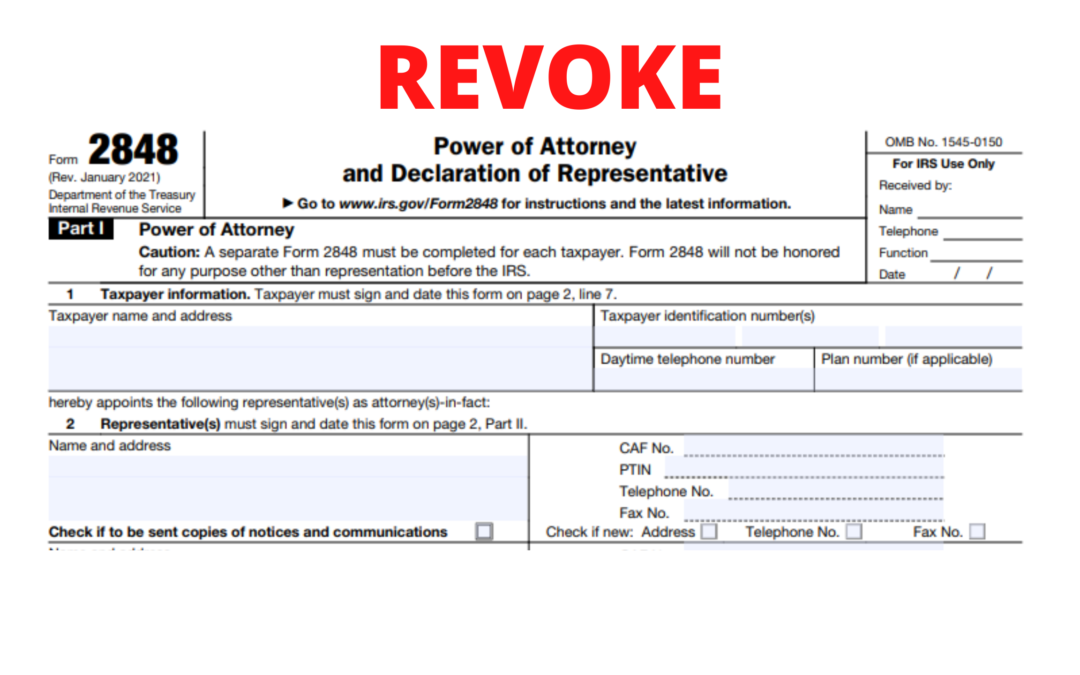

In our last blog post we walked you through how to submit a Power of Attorney online. If you missed it, you can catch up here: Submitting Power of Attorneys and Tax Information Online But, what if you’re no longer satisfied with your current representative? Or,...

by Matthew Senter | Sep 3, 2021 | Tax

You have probably been hearing a lot of talk about possible tax law changes lately. Considering all the changes that we’ve had over the last two years, this year may be as important as ever for good tax planning, especially with the likelihood of future tax rates...

by Cassie Senter | Aug 16, 2021 | Accounting, Government, Internal Revenue Service, Tax

Getting your tax documents together to send to your tax preparer can be overwhelming, but we can help! One of the most common questions we are often asked is, “What documents are needed for individual tax returns?”. Below is a list of some basic...