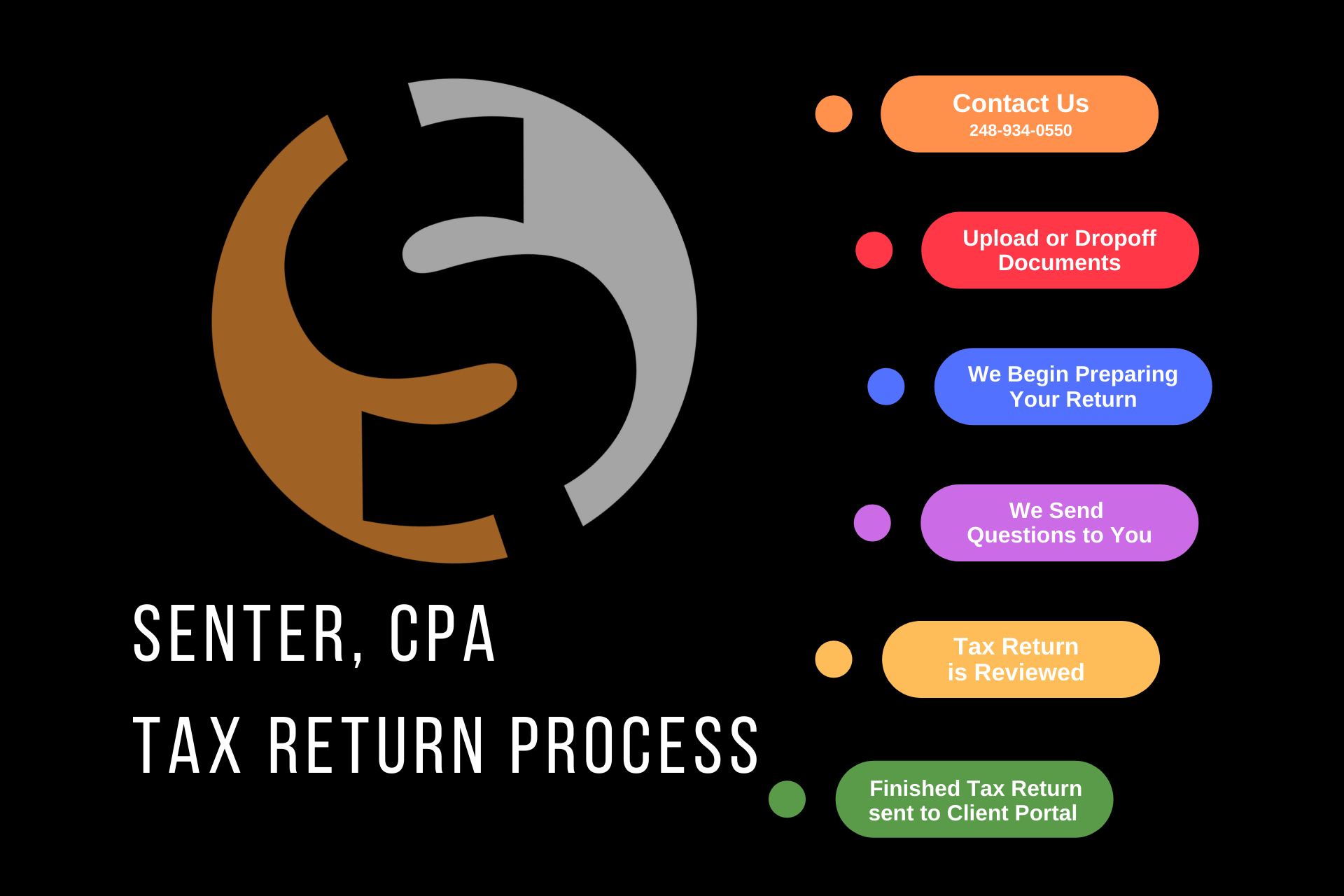

How Our Process Works

Step 1: Contact Us

- Telephone: 248-934-0550

- Use our online contact Form: HERE (or use the contact form below)

Step 2: Upload Your Documents to Our Secure Portal

- A meeting isn’t required for us to prepare you taxes. Once you decide that Senter, CPA is a good fit for you, we will provide you with a link to your personal, secure portal, which we will use for 90% of the process.

- You can scan or take pictures of all documents, and then upload them to your portal.

- If you are not technology savvy, you’re more than welcome to drop your documents off at our office. Just call ahead to make sure someone will be available to greet you.

Step 3: We Begin Preparing Your Return

- Once we get copies of your last two tax returns and current year documents, one of our preparers will begin working on your return.

Step 4: Request Additional Information

- We will contact you via email, phone, or set up a video meeting if we have any questions or need additional information.

Step 5: Tax Return Review

- Once your return has been prepared and near completion, a CPA will review and analyze the return for any planning strategies for current and future years.

- This part of the process is to ensure your tax return is prepared accurately and to identify anything that may be missed, or strategies to take advantage of.

Step 6: Tax Return Sent to Client Portal

- Once complete, your return will be sent to your secure portal for you to review.

- Once approved for e-filing, documents will be sent to you for your e-signature.

- Invoices can be paid online right in your portal.