Getting your tax documents together to send to your tax preparer can be overwhelming, but we can help! One of the most common questions we are often asked is, “What documents are needed for individual tax returns?”.

Below is a list of some basic information your tax preparer will need, along with some of the most common documents one might receive. This is a simple overview of the most common documents needed for tax season, but remember, everything listed may not apply to you. If you would like a more thorough checklist, reach out to us and we can send one to you!

Basic Information

- Full Legal Name, Spouse’s Full Legal Name, Social Security Numbers and Birthdates

- Same info for your children

- Your Email Address and Spouse’s Email Address (each individual needs a unique email address, per the IRS for e-signature guidelines)

- Checking or Savings Account info – Routing number, account number, and account type (if you are doing direct deposit)

Common Forms (this is not a complete list)

- W2’s

- W-2-G – Gambling Income

- Schedules K-1 – Share of Income, Deductions and Credits

- 1099’s (there are many different types of 1099’s. Send everything you receive and let us know if you are expecting additional forms) Some examples Include:

- 1099-B – Stock/Mutual Fund Transactions

- 1099-R – IRA Distributions

- 1099-G – Unemployment, State and Local Refunds

- 1099-MISC – Rents, Royalties and Other Income

- 1099-NEC – Independent or Contract Work

- 1099-INT – Interest Income

- 1099-DIV – Dividends

- 1099-B – Stock Sales

- 1099 Composite – Investment Income

- 1099-S (if you sold a home)

- 1099-SA – HSA Distributions

- SA-1099 – Social Security Benefit

- 1095-A, -B, -C – Health Insurance Documentation

- 1098 – Mortgage Interest

- 1098-T – Tuition Paid

- 1098-E – Student Loan Interest

- 5498 – IRA and HSA Contributions

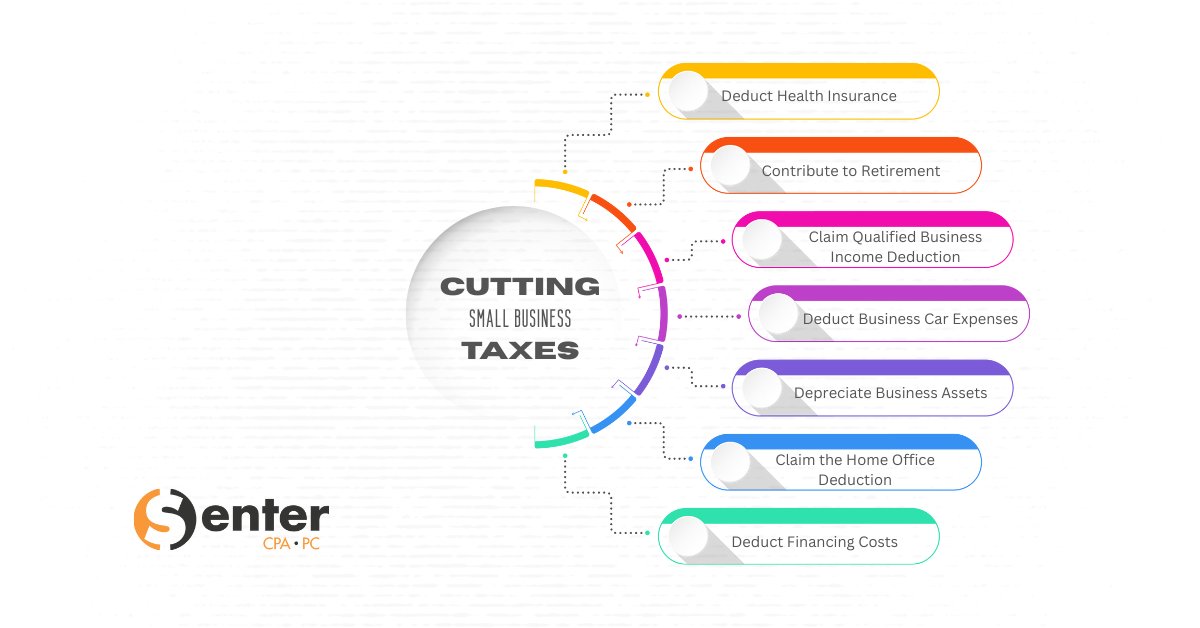

Other Helpful Information/Documentation

- Alimony Received

- Rental Property Income and Expenses

- Business Income and Expenses

- Any Letters or Communication from the IRS

- Child Care Expenses

- Teacher Expenses

- Medical/Dental Expenses

- Charitable Donations

- Real Estate Taxes Paid

- Other Income and Expenses

- 1040-ES – Summary of Estimated Tax Payments Made

- IRS Notice 1444 or other records showing economic stimulus payments

- Advance Child Tax Credit Payments Received

- Identity Protection PIN (if issued by the IRS)

- New Clients should send the previous 2 years State and Federal tax returns.

This is not an exhaustive list of everything you may receive and need to submit to the IRS, but this should give you a general idea of what your tax preparer will need from you.

All documents can be submitted through our secure client portal. Find more information regarding our NEW client portal HERE!

If you have any questions or need further assistance, don’t hesitate to reach out to us at 248-934-0550.