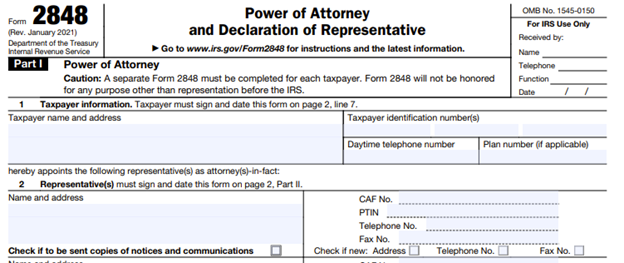

Did you know there is an option to submit Power of Attorneys and Tax Information Authorizations online?

Although there may be times when filling out a physical form is the best option, submitting the form electronically is definitely a faster, more streamlined process compared to completing it by hand. Here’s how it works:

PREPARE

You can begin the process for submitting the form electronically HERE.

To request a POA online, the taxpayer will need to provide their tax professional (CPA, Attorney, EA, etc.) with the following information:

- Centralized Authorization File (CAF) number

- Name and address on file with the IRS for their CAF number

- Taxpayer’s name and address on file with the IRS

- Taxpayer’s Social Security number or Taxpayer Identification Number

- Tax matters and periods for which they are requesting authorization are limited to the following matters from the year 2000 forward:

- Form 1040 Income Tax

- Split Spousal Assessment or Form 8857 Innocent Spouse Relief

- Shared Responsibility Payment

- Shared Responsibility Payment – Split Spousal Assessment

- Civil Penalty (limited to periods of March, June, September, and December)

COMPLETE THE REQUEST

- It should take about 15 minutes to complete the request. Note: you cannot save requests to continue working on later.

- After you submit the request, you’ll get a confirmation that it’s been sent to the taxpayer’s online account.

- If the information you entered for the taxpayer is not correct, they will not see the request in their online account.

CONTACT THE TAXPAYER

- Ask the taxpayer to log into their account to review and electronically sign the authorization request at www.irs.gov/account

- For multiple representatives requesting authorization for the same tax matter and period:

- Ask the taxpayer to authorize all representatives on the same day

TAXPAYER AUTHORIZES OR REJECTS THE REQUEST

- The taxpayer logs into their account at www.irs.gov/account to authorize or reject the request.

- The authorization will be processed after the taxpayer approves and electronically signs. Allow up to 2 business days to process after the taxpayer signs.

- The taxpayer may print the confirmation and give you a copy of the signed authorization.

- The IRS won’t notify you if the taxpayer rejects the request or if the request failed to process

- Contact the taxpayer with any questions about the status of a request.

- Submitting with Tax Pro Account will revoke any prior authorization(s) on file with the IRS for the same tax matter and period.

- If you don’t want a prior authorization to be revoked, use Form 2842.

- Form 2842 Power of Attorney and Declaration of Representative instructions can be found here: https://www.irs.gov/instructions/i2848