Building a network of well-connected financial professionals is a crucial means of personal wealth management. A dream team of experts will provide service and support towards working for and achieving your financial goals, while monitoring progress along the way. These collaborative relationships ultimately ensure that your financial future and legacy are well-protected, even in catastrophic circumstances.

Admittedly, the framework can be daunting when assembling your network. Where should you start? Who should you meet with? How do you establish a relationship between industry professionals? We are here to simplify the process. Below are the four most impactful players to recruit on your dream team.

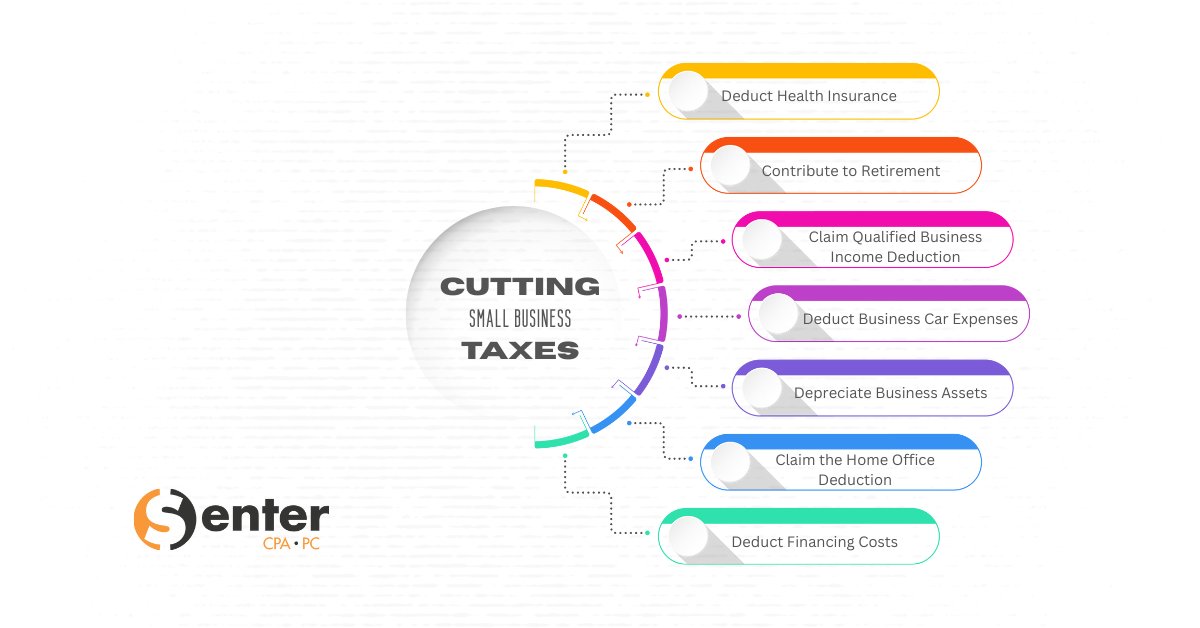

Certified Public Accountant (CPA)

Accountants provide an overall view of your tax situation and are capable of running projections creating a deeper understanding of tax liability and tax opportunity now and in the future. Consider searching for an advisor who is a licensed Certified Public Accountant (CPA), as this designation is one of the most trusted, respected, and recognized in the financial industry. CPA’s carefully study tax laws, regulations, and monitor changes in existing tax code, which will strategically optimize your tax opportunity.

Your tax accountant will work closely with your financial advisor in a collaborative effort to manage your financial affairs. These two professionals are the core and powerhouse to your dream team.

Financial Advisor (FA)

Financial advisors and their investors build a relationship through comprehensive financial analysis. FA’s will help you properly plan for retirement and manage your investments. If you have children or grandchildren, these advisors can also establish college savings plans, such as a 529, yielding both tax and financial aid benefits. When searching for a FA, search preferably for someone with a Certified Financial Planner (CFP) designation. With this esteemed accreditation, you can feel secure your advisor is providing financial advice and recommendations, based upon what is in your best interest and will encompass a wealth of knowledge and commitment toward personal financial planning. Through a variety of investment vehicles, you can expect your advisor to build your portfolio around your needs and risk tolerance.

Estate Attorney

When searching for an estate planning attorney, you should feel comfortable to utilize the resourcefulness of your previous two key players: your tax accountant and financial advisor. Often times, generating referrals from other professionals on your team facilitate the lines of communication between industries. Mutual clients or shared clients allow for financial transparency and accountability, while working as a whole to move your financial goals forward.

Recruiting an estate attorney will allow you to plan for life’s unexpected and difficult transitions. Documents such as power of attorney, trusts and wills are prepared to distribute your property and protect your legacy against liability or conflict. Finalizing a plan for your assets at death is the best way to ensure proper estate planning for your heirs and, if applicable, a business.

Insurance Agent

Enlisting an agent to evaluate your financial risks is a significant means of managing and safeguarding your wealth. These agents are able to help you plan for potential damages, elder care and cash flow down the road. While most of us appreciate the importance of health insurance and asset coverage (think: home and vehicle) depending on your set of circumstances life insurance, term insurance and/or long-term care may equally be as important.

Collaborating with an tax accountant, financial advisor, estate attorney and insurance agent will bring you and your family peace of mind that your finances are in strategic, advantageous order, while also being protected.

One last crucial bit of advice: be selective. Properly vet each professional and ensure compatibility with your personality and investment style.

Consulting with your Dream Team of professionals is key to financial and legacy planning. If you have any questions or concerns relative to your personal situation and potential strategy, please contact us HERE or give us a call at 248-934-0550. We would be honored to help.