Freelancer is a term we see a lot these days and the tax implications are different than as an employee. An employee has the luxury of their employer withholding and paying their tax to the appropriate taxing authorities on their behalf. A freelancer does not. In its simplest form a freelancer is a sole proprietor for income tax purposes. Becoming self-employed as a freelancer comes with great flexibility of being your own boss but one should be mindful of proper record keeping requirements and timely tax payments. Feelancing and taxes are becoming a problem for those not timely paying and planning for taxes.

Income and Deductions

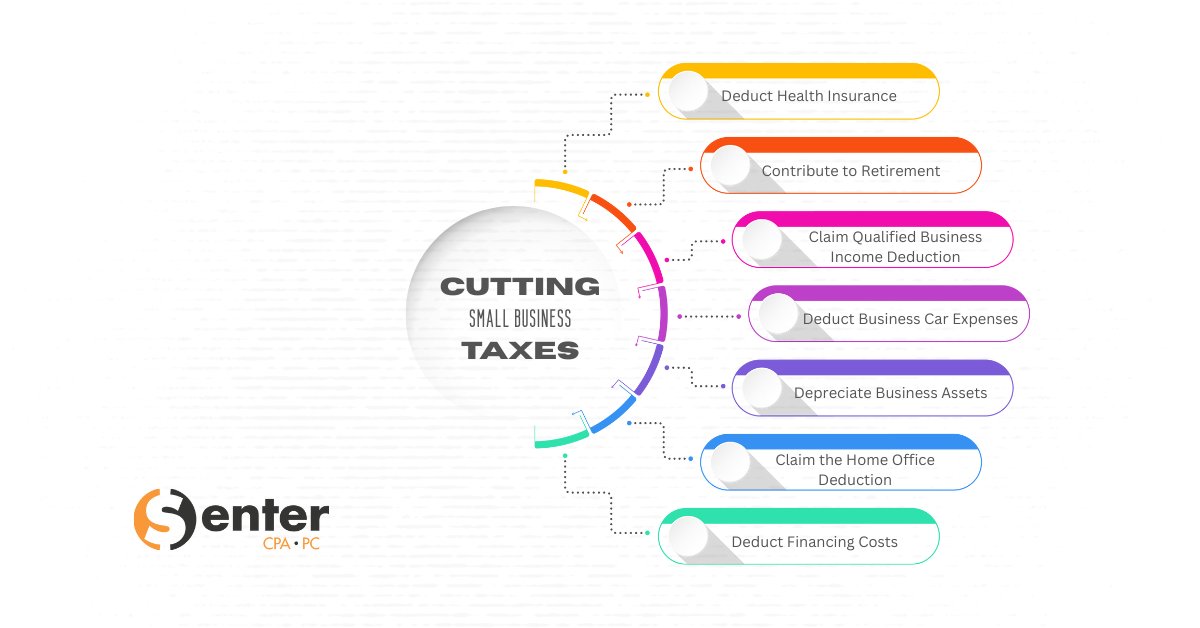

A freelancer is tasked with tracking income and expenses for calculating income tax and related filings. Tax is calculated on taxable income (revenue less deductible expenses) and typically reported on Schedule C of Form 1040. Income tracking is fairly simple, but many do not take advantage of available deductions. Those may include (but certainly not limited to) advertising, supplies, travel, business related meals, home office, professional fees etc.

Self-employment Tax

Since a freelancer is considered self-employed, they now must pay self-employment tax which is another term for Social Security and Medicare tax. A self-employed individual pays both the employer and employee portion which is approximately 15.3% in addition to federal income tax (and state if you live in a state with income tax). An employee has the luxury of an employer bearing ½ of the Social Security and Medicare tax along with withholding and remitting to the IRS on their behalf. A freelancer must do this on their own or work with a quality Certified Public Accountant (CPA).

Quarterly Estimates

Quarterly estimates should be calculated for two reasons:

- To ease the burden of the amount due into 4 installments

- To ensure no penalties or interest are paid for late payment of tax

Most taxpayers will avoid penalties and interest if they owe less than $1,000 in tax (after withholding and credits) or if estimated tax payments cover at least 90% of the current year tax or 100% of last years tax (110% if AGI is over $150,000). When calculating quarterly estimates be sure to account for income tax and self-employment tax on taxable freelance income. Click HERE for full details from the IRS.

Accounting and Recordkeeping

In the event of an audit by a taxing authority a freelancer will need to keep record of income and deductions as support of the filing. As such having a good accounting system in place and keeping detailed records of income and deductions will ease this burden.

As your freelance business grows, the accounting and income tax calculations may become more complex so you may want to consider incorporating for liability protection and/or for income tax purposes. If you have any questions regarding the accounting needs for your freelance business or need any help calculating tax on your income, please reach out to us! We can help! Contact us HERE.