What a wild ride 2022 has been!

Here at Senter, CPA we had an incredible 2022. We spent the year assisting clients, continuing to contribute to our communities, and growing our team. We have added two full time TEAM members who have greatly strengthened our service capabilities. We’ve also added an annual tax season TEAM member who is an Enrolled Agent so you (and we) should notice an improvement to our turnaround time come the 2023 tax season. Wow! That will make us a TEAM of 6.

It’s funny to think 2022 is coming to a close as it feels as though I was just writing this blog for 2021. We have been busy working hard, having fun and are eager to put 2022 behind us and take on 2023.

We strongly believe our success stems from our wonderful clients who value our services and who have been quick to tell their friends, family, and colleagues about us. We value the work we do and consider it our duty to add value to our clients and to be a contributing part in our communities.

As always, we want to extend our sincere gratitude for the overwhelming response from our amazing clientele. Because of you, we were able to overcome all obstacles, and continue to grow and flourish as a firm, as a team, and service to our community. We are very grateful.

2022 Team Senter, CPA Highlights

(Click the orange text for additional details)

The Senter Family

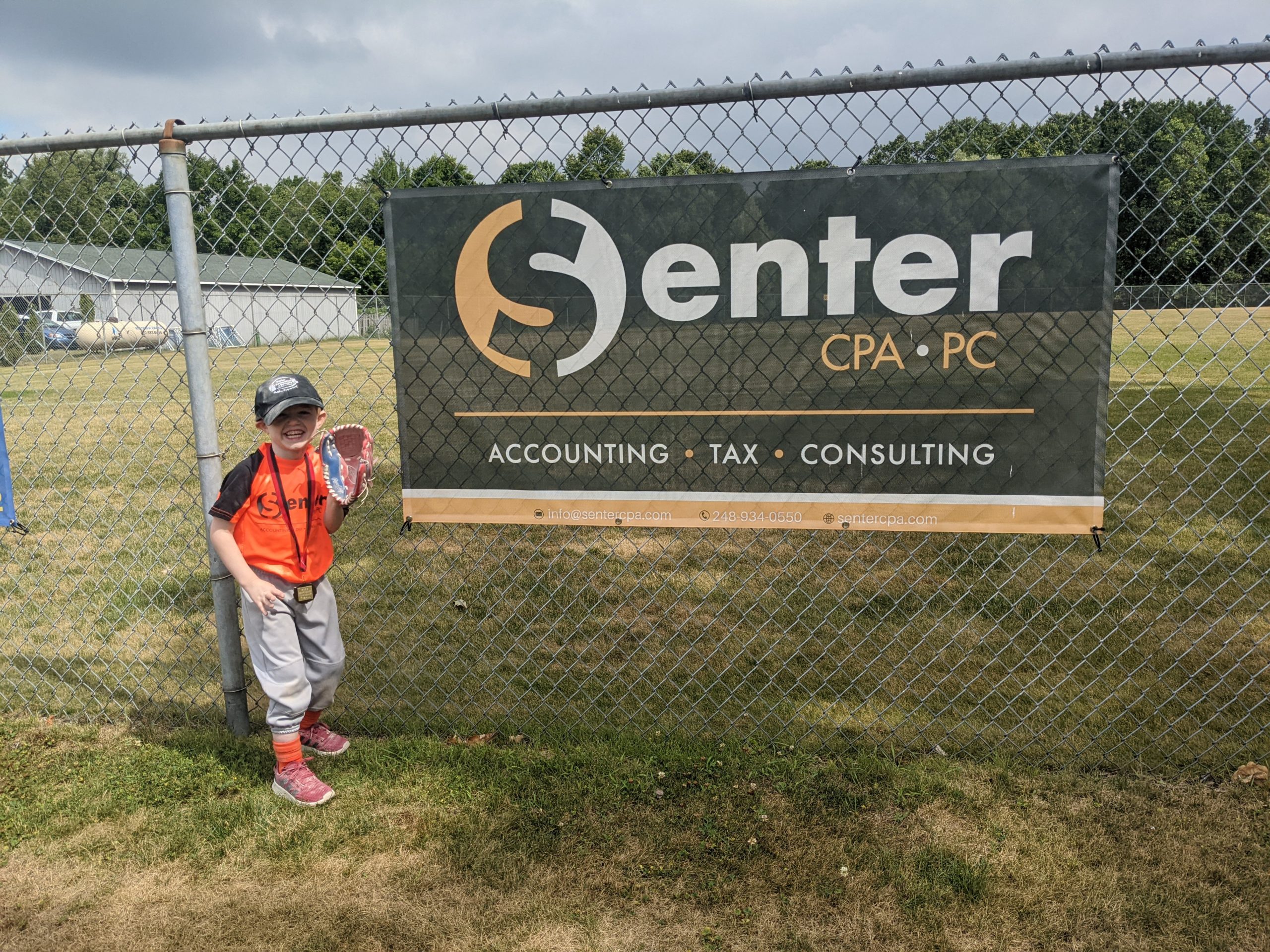

Our family is a lively bunch and are doing better than ever. The three kiddos are still growing faster than they should. Ben (15), Waylon (6), and Charlotte (4). They always keep us on our toes.

Ben is still growing his musical talents and guitar collection. He can play most rock band instruments you put in front of him and is a self-learner. Super fun to watch him play and see his passion for music. Waylon has tried his hand at many sports this year which include T-ball, soccer, basketball, and his favorite Ninja Warriors. He lost his first two teeth. He still enjoys rough housing with Ben and playing Minecraft in all his other spare time. Charlotte keeps creeping up on Waylon’s height and is sweet as they come (when she wants to be). She is still infatuated with cats and enjoying her time at the Clarkston Funshine program two days a week.

Per usual for Cassie and I, our year consisted of hard work, a few trips to Tennessee to visit family, a trip or two up north, work, school and all the other fun kids activities.

The Senter crew certainly works hard but plays hard.

To Our Clients and Friends

Our faithful supporters are what allows us to continue to thrive year after year. Whether that be our clients, friends, or colleagues, we would not be where we are today without you. So, we want to say THANK YOU for your continued support, your value of our services, and for continuing to be flexible in the variety of ways we are able to serve you.

We genuinely enjoy what we do and are looking forward to 2023 as we to continue to serve you, to grow as a TEAM, and to be supporters of our communities.

We hope your 2022 was awesome and we want to wish you a successful 2023! We look forward to the journey at your side.

We are always here for you and look forward to seeing you soon. In the meantime, please feel free to call us at 248-934-0550 or contact us HERE. If you’d like to stay in close and continuous contact with us, be sure to like us on Facebook, follow us on LinkedIn, subscribe to our monthly newsletter and frequent our blog page.

Want to revisit our prior years in review? You can find them at these links:

Here’s to a wonderful 2023!