by Robin Scrace | Mar 25, 2022 | Internal Revenue Service, Tax

What Is a Tax Extension? A tax extension simply gives you extra time to file your taxes, six extra months to be exact. If you request an extension, it will be granted automatically, but the extension form 4868 must be filed no later than midnight on April 18th....

by Rosemary Shamoon | Mar 11, 2022 | Internal Revenue Service, Tax

Key Filing Dates There are several important dates taxpayers should keep in mind for this year’s filing season: January 14th IRS Free File opens. Taxpayers can begin filing returns through IRS Free File partners; tax returns will be transmitted to the IRS...

by Robin Scrace | Feb 23, 2022 | Courses, Internal Revenue Service, Tax

Did you know that you have the option to make your state and federal income tax payments online? You can pay your state and federal income tax online, by phone, or with your mobile device using the IRS2Go app. If you’re not sure where to go to make the payments,...

by Robin Scrace | Feb 14, 2022 | Community, Internal Revenue Service, Tax

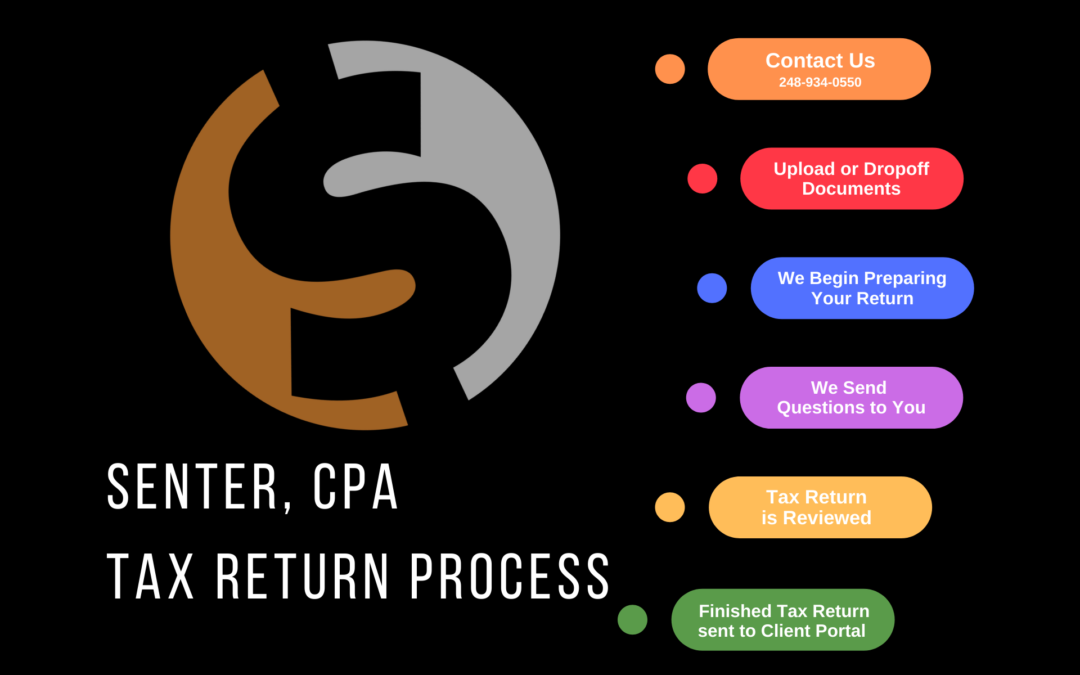

How Our Process Works Step 1: Contact Us Telephone: 248-934-0550 Use our online contact Form: HERE (or use the contact form below) Step 2: Upload Your Documents to Our Secure Portal A meeting isn’t required for us to prepare you taxes. Once you decide that...

by Matthew Senter | Jan 28, 2022 | Accounting, Community, Tax, Team

Hey folks! Want to stay up-to-date on all things Senter, CPA? Then we would like to personally invite you to subscribe to our monthly newsletter. Once a month we prepare and send a newsletter to our clients, friends and colleagues. Most of the content is drawn from...

by Rosemary Shamoon | Jan 26, 2022 | Tax

A power of attorney, or POA, is a legal document that gives another person the authority to make decisions on their behalf. POAs come in different forms, each suited for a specific purpose. Here we will look at 3 different types of POAs and explain why you may receive...