Are you wondering how you can get your tax returns done properly and efficiently, while paying as little as possible, AND doing your part to reduce the spread of COVID-19? Whether you are used to curbside service and contactless shopping and delivery, or if you’re just plain ole lazy, Senter, CPA has you covered with our contactless tax return process.

A few things you’ll enjoy during your virtual tax preparation:

- This may be a contactless, no-touch, virtual process, but we will be in contact with you the entire process.

- You will have access to expert tax professionals and CPAs.

- You can use your preferred technology and devices.

- You can enjoy the comfort of your own home, no need to schedule a time to come in the office.

- You’ll be treated to fast and efficient service.

- Our caring, Senter, CPA TEAM will be working for YOU.

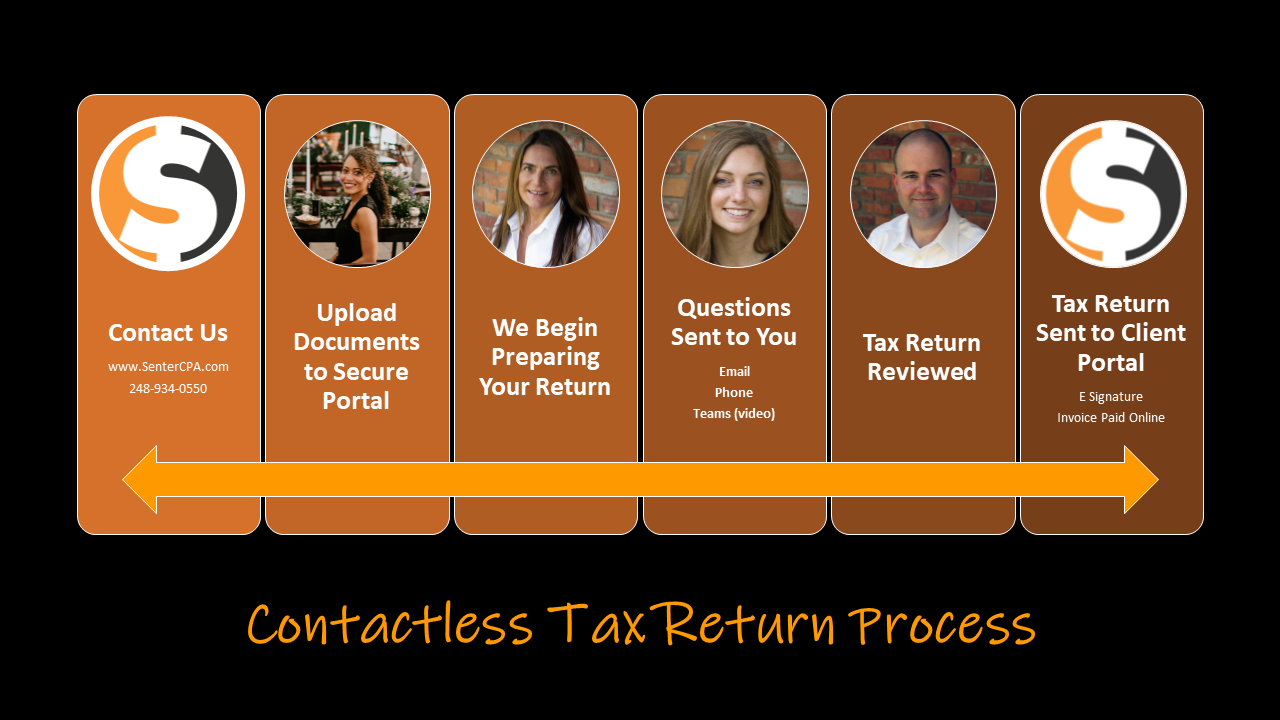

How It Works

Step 1: Contact Us

- Telephone: 248-934-0550

- Use our online contact Form: HERE (or use the contact form below)

Step 2: Upload Your Documents to Our Secure Portal

- Once you decide that Senter, CPA is a good fit for you, we will provide you with a link to your personal, secure portal, which we will use for 90% of the process.

- You can scan or take pictures of all documents, and then upload them to your portal.

- If you are not technology savvy, contactless drop off is accommodated (just mask up, stop by the office, and drop off your documents at the front desk).

Step 3: We Begin Preparing Your Return

- Once we get copies of your last two tax returns and current year documents, one of our preparers will begin working on your return.

Step 4: Request Additional Information

- We will contact you via email, phone, or set up a video meeting if we have any questions or need additional information.

- This part of the process is to ensure your tax return is prepared accurately and to identify anything that may be missed, or strategies to take advantage of.

Step 5: Tax Return Review

- Once your return has been prepared and near completion, a CPA will review and analyze the return for any planning strategies for current and future years.

Step 6: Tax Return Sent to Client Portal

- Once complete, your return will be sent to your secure portal for you to review.

- Once approved for e-filing, documents will be sent to you for your e-signature.

- Invoices can be paid online right in your portal.

That’s it!

Let’s continue to stay safe and get your taxes done right!