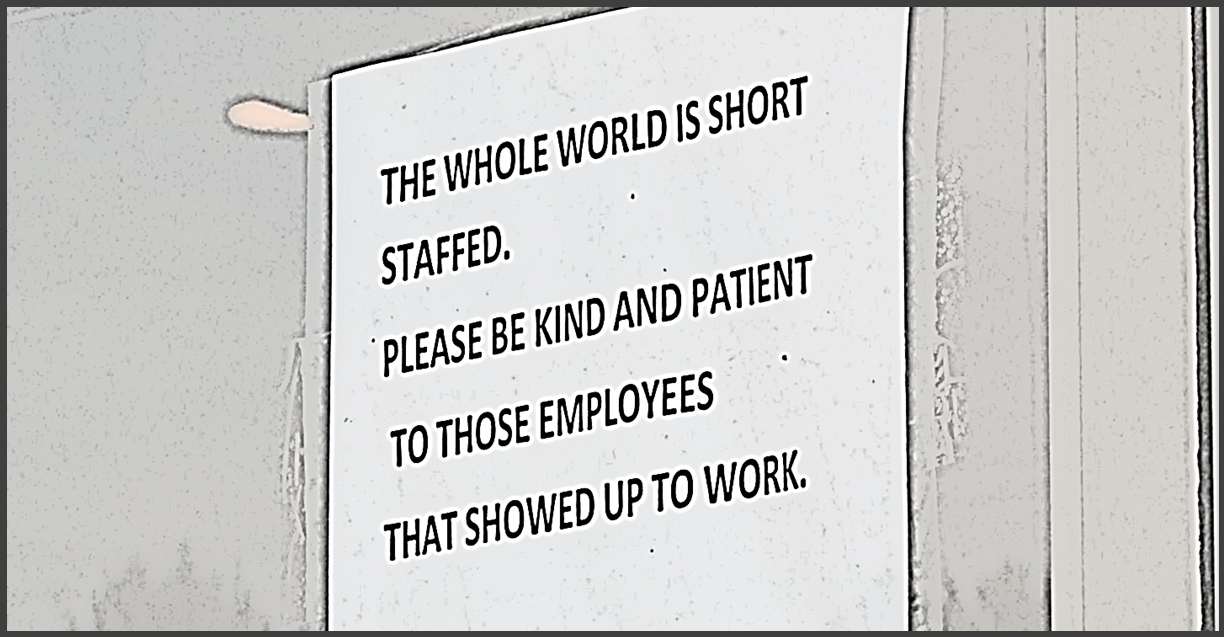

From fast-food restaurant lobbies closing, drive thru banking and pharmacies having longer wait times, to many businesses reducing operating hours; a shortage of employees is being heavily noticed across all industries, with accounting being no exception.

There are numerous causes leading us to this point, below are just a couple:

- There is a widening gap between CPAs reaching retirement age and college graduates entering the workforce.

- These college graduates are being offered positions that their accounting degrees qualify them for without the stringent requirements of a CPA license.

HERE at Senter, CPA we plan to stay ahead of this shortage by continuing to value our talented team and evolve our business operations to handle these uncertain times, while supporting our clients long-term. Our services are provided virtually, as well as in-person, to suit each client’s needs, making us easily accessible to clients near and far. Senter, CPA will be a calming force to aid in maintaining confidence in both personal and business financials.

Although we are ahead of this shortage, we do ask for grace, patience, and understanding through our extremely busy season we are entering. Our clients are our top priority, and we will treat each circumstance with the utmost respect and integrity with as much timeliness as possible.

“The Best Way to Find Yourself is to Lose Yourself in the Service of Others.” – Mahatma Ghandi