Goodbye 2023, Hello 2024!

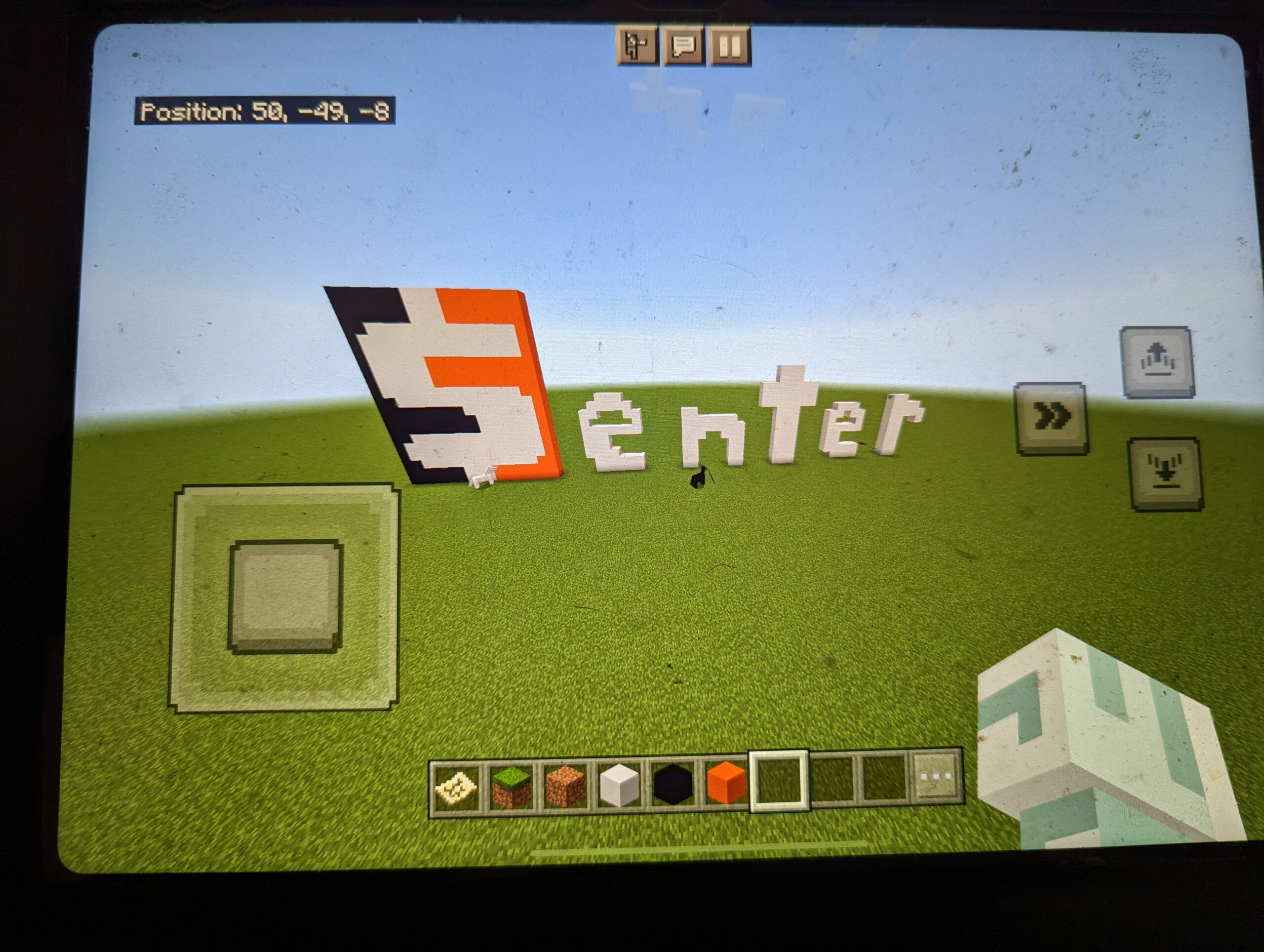

What a year 2023 was for us here at Senter CPA! We spent the year assisting clients with all things accounting and tax, sharpening our processes, moving our offices, continuing to contribute to our communities, and growing our team. We have added a new full-time TEAM member who has greatly strengthened our skills. We’re proud to be an extension of your TEAM.

Now that we have 2023 behind us, it’s exciting to look back at all we have accomplished and the memories we’ve made. We’ve been busy working hard, having fun and are eager to work hard for you in 2024.

We strongly believe our TEAM’s success stems from our wonderful clients who value our services and the wonderful families and communities that support us. We value the work we do and consider it our duty to add value to our clients and to be a contributing part of our communities.

As always, we want to extend our sincere gratitude for the overwhelming response from our amazing clientele. Because of you, we were able to overcome all obstacles, and continue to grow and flourish as a firm, as a team, and service to our community. We are very grateful.

2023 Team Senter, CPA Highlights

(Click the orange text for additional details)

- We started a new tradition to reward our team members for their hard work by going to a 4 day work week from Memorial Day – Labor Day

- We continued to help the Rotary Club of Clarkston grow the Dolly Parton’s Imagination Library

- Jordan Middleton joined our TEAM and brought many years of accounting and corporate tax experience to our TEAM

- We sponsored the Clarkston High School Golf Team

- We sponsored the Clarkston SCAMP Walk and Roll

- Matt worked out of town

- Our TEAM played in the Annual Clarkston Area Chamber of Commerce Golf Outing

- WE’VE MOVED!

- Our New Address

- We watched Tennessee beat Michigan State in basketball

- We spent the day volunteering at Disaster Relief at Work

The Senter Family

Our family is living life to the fullest. The three kiddos are still growing faster than they should. Ben (16), Waylon (7), and Charlotte (5). They are a wild bunch for sure.

Ben is now 16, that’s right, we have a driver on our hands. You’ll see him cruising around in his truck soon, so look out. He is still growing his musical talents and playing video games. Selfishly I’m excited to tell you that he has become an avid fisherman like me. I’ve thoroughly enjoyed watching him want to spend more time on the water than I do. I still do my best to out fish him when I can.

Waylon is still up to his jokester ways and enjoying year-round Ninja Warriors. He loves video games so much that we must constantly remind him to go get fresh air outside. He has really blossomed into a beautiful young boy with a wonderful personality and is enjoying the 1st grade. It’s hard to get a word in when he is around but he is sure to make you laugh.

Charlotte has now entered the young 5’s in Clarkston and is doing great. It’s a bit tough on the parents with all of her food allergies but she enjoys going to school, meeting new friends and learning. She enjoys making a mess but most of all building Lego sets with mom. She’s sweet and kind.

In 2023 Cassie and I bought a camper and took the kids on several camping trips across the state. We took our usual trips to Tennessee to visit family and friends. We had our 10-year anniversary in April and took a trip to Las Vegas to enjoy each other’s company and like the wild and crazy kids we are, we took another trip to Las Vegas just after Christmas. We had a great year traveling, doing new things and enjoying time with the kids.

The Senter crew certainly knows how to have a good time!

To Our Clients and Friends

Our faithful supporters are what allows us to continue to thrive year after year. Whether that be our clients, friends, or colleagues, we would not be where we are today without you. So, we want to say THANK YOU for your continued support, your value of our services, and for continuing to be flexible in the variety of ways we are able to serve you.

We genuinely enjoy what we do and are looking forward to 2024 as we to continue to serve you, to grow as a TEAM, and to be supporters of our communities.

We hope your 2023 was awesome and we want to wish you a successful 2024! We look forward to the journey at your side.

We are always here for you and look forward to seeing you soon. In the meantime, please feel free to call us at 248-934-0550 or contact us HERE. If you’d like to stay in close and continuous contact with us, be sure to like us on Facebook, follow us on LinkedIn, subscribe to our monthly newsletter and frequent our blog page.

Want to revisit our prior years in review? You can find them at these links:

- 2022 Senter, CPA Year in Review

- 2021 Senter, CPA Year in Review

- 2020 Senter CPA Year in Review

- 2019 Our Year in Review

Here’s to a wonderful 2024!