by Rosemary Shamoon | Mar 11, 2022 | Internal Revenue Service, Tax

Key Filing Dates There are several important dates taxpayers should keep in mind for this year’s filing season: January 14th IRS Free File opens. Taxpayers can begin filing returns through IRS Free File partners; tax returns will be transmitted to the IRS...

by Robin Scrace | Feb 14, 2022 | Community, Internal Revenue Service, Tax

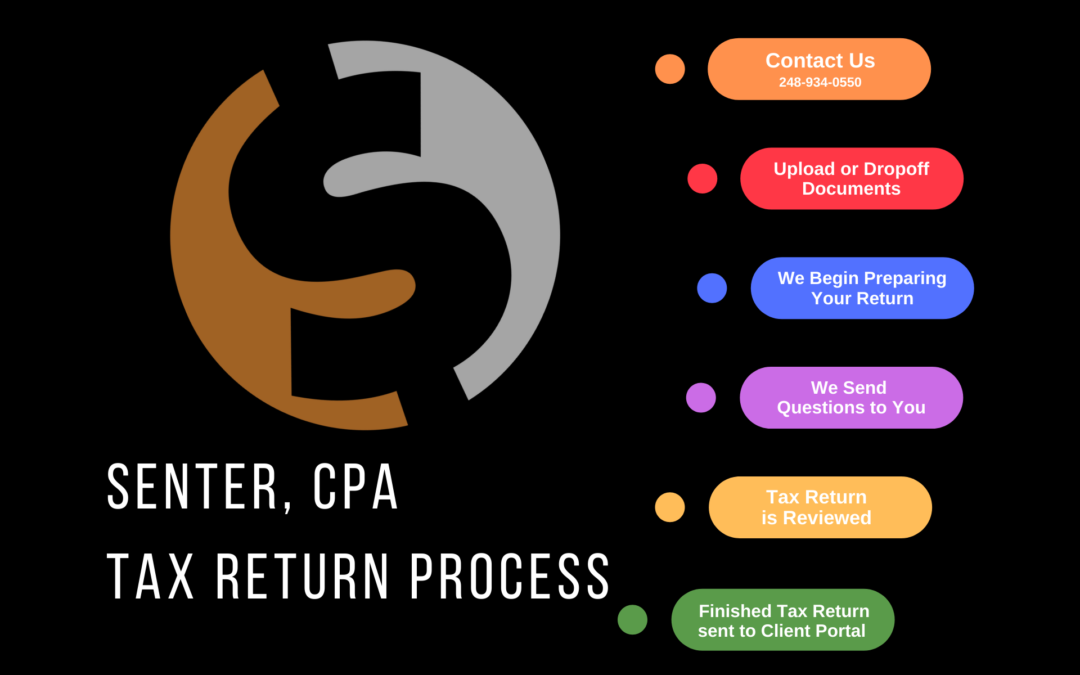

How Our Process Works Step 1: Contact Us Telephone: 248-934-0550 Use our online contact Form: HERE (or use the contact form below) Step 2: Upload Your Documents to Our Secure Portal A meeting isn’t required for us to prepare you taxes. Once you decide that...

by Rosemary Shamoon | Jan 26, 2022 | Tax

A power of attorney, or POA, is a legal document that gives another person the authority to make decisions on their behalf. POAs come in different forms, each suited for a specific purpose. Here we will look at 3 different types of POAs and explain why you may receive...

by Matthew Senter | Nov 16, 2021 | Internal Revenue Service, Tax

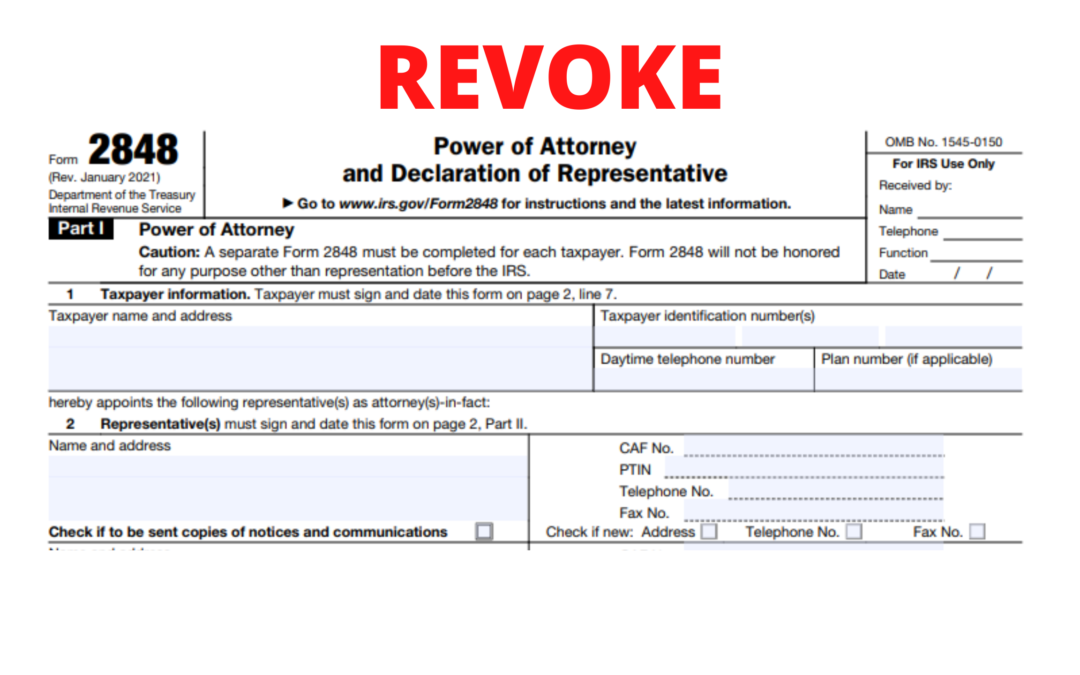

In our last blog post we walked you through how to submit a Power of Attorney online. If you missed it, you can catch up here: Submitting Power of Attorneys and Tax Information Online But, what if you’re no longer satisfied with your current representative? Or,...

by Matthew Senter | Nov 9, 2021 | Tax

Did you know there is an option to submit Power of Attorneys and Tax Information Authorizations online? Although there may be times when filling out a physical form is the best option, submitting the form electronically is definitely a faster, more streamlined process...