by Rosemary Shamoon | Mar 11, 2022 | Internal Revenue Service, Tax

Key Filing Dates There are several important dates taxpayers should keep in mind for this year’s filing season: January 14th IRS Free File opens. Taxpayers can begin filing returns through IRS Free File partners; tax returns will be transmitted to the IRS...

by Robin Scrace | Feb 14, 2022 | Community, Internal Revenue Service, Tax

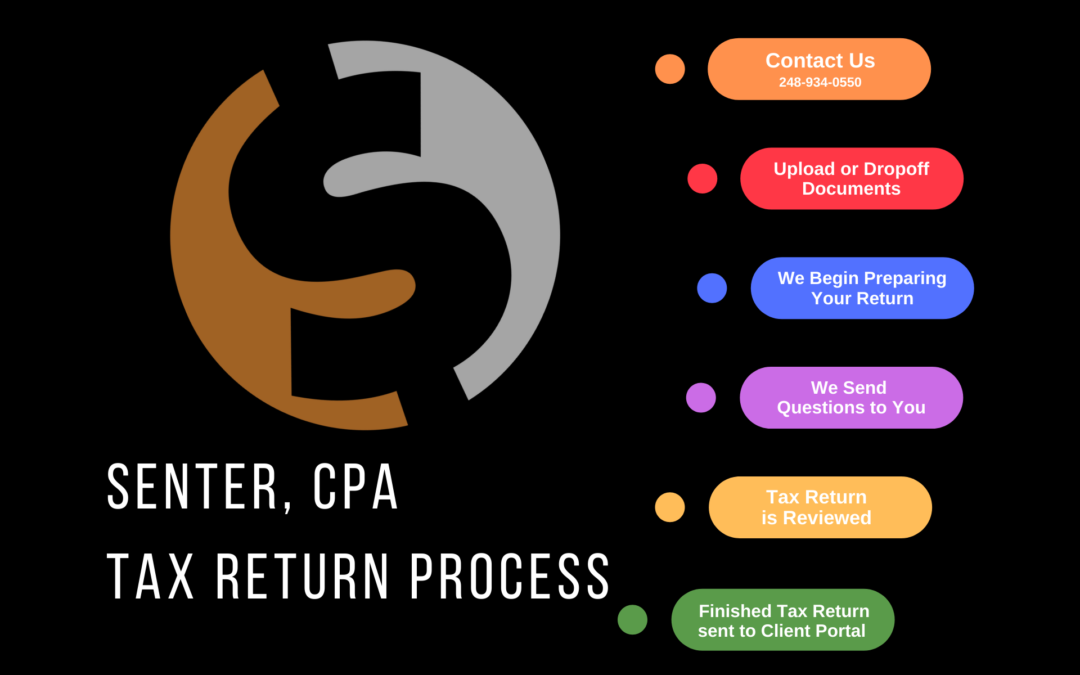

How Our Process Works Step 1: Contact Us Telephone: 248-934-0550 Use our online contact Form: HERE (or use the contact form below) Step 2: Upload Your Documents to Our Secure Portal A meeting isn’t required for us to prepare you taxes. Once you decide that...

by Matthew Senter | Nov 16, 2021 | Internal Revenue Service, Tax

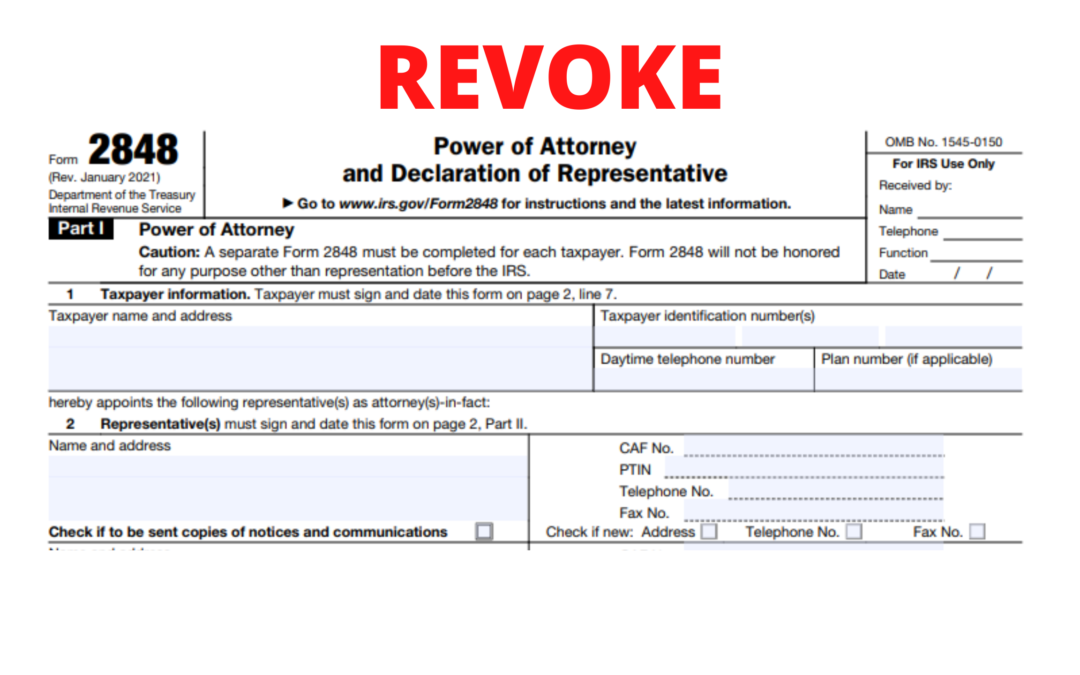

In our last blog post we walked you through how to submit a Power of Attorney online. If you missed it, you can catch up here: Submitting Power of Attorneys and Tax Information Online But, what if you’re no longer satisfied with your current representative? Or,...

by Cassie Senter | Aug 16, 2021 | Accounting, Government, Internal Revenue Service, Tax

Getting your tax documents together to send to your tax preparer can be overwhelming, but we can help! One of the most common questions we are often asked is, “What documents are needed for individual tax returns?”. Below is a list of some basic...

by Matthew Senter | Jun 16, 2021 | Tax

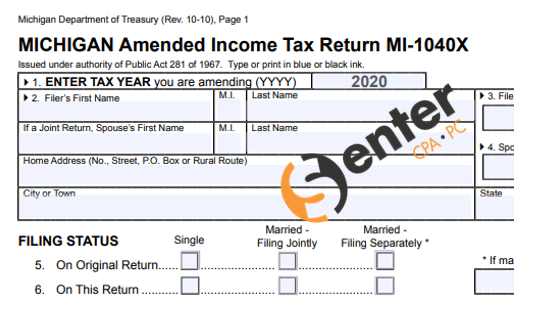

On March 11, 2021, The American Rescue Plan Act included a provision to exclude $10,200 of unemployment compensation from taxable income if the taxpayer’s modified AGI was $150,000 or less. On April 1st, the State of Michigan notified taxpayers that they would...