by Matthew Senter | Nov 9, 2021 | Tax

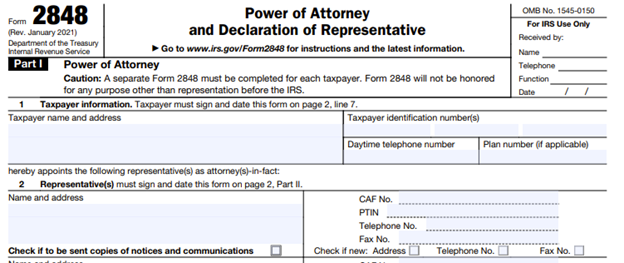

Did you know there is an option to submit Power of Attorneys and Tax Information Authorizations online? Although there may be times when filling out a physical form is the best option, submitting the form electronically is definitely a faster, more streamlined process...

by Matthew Senter | Sep 3, 2021 | Tax

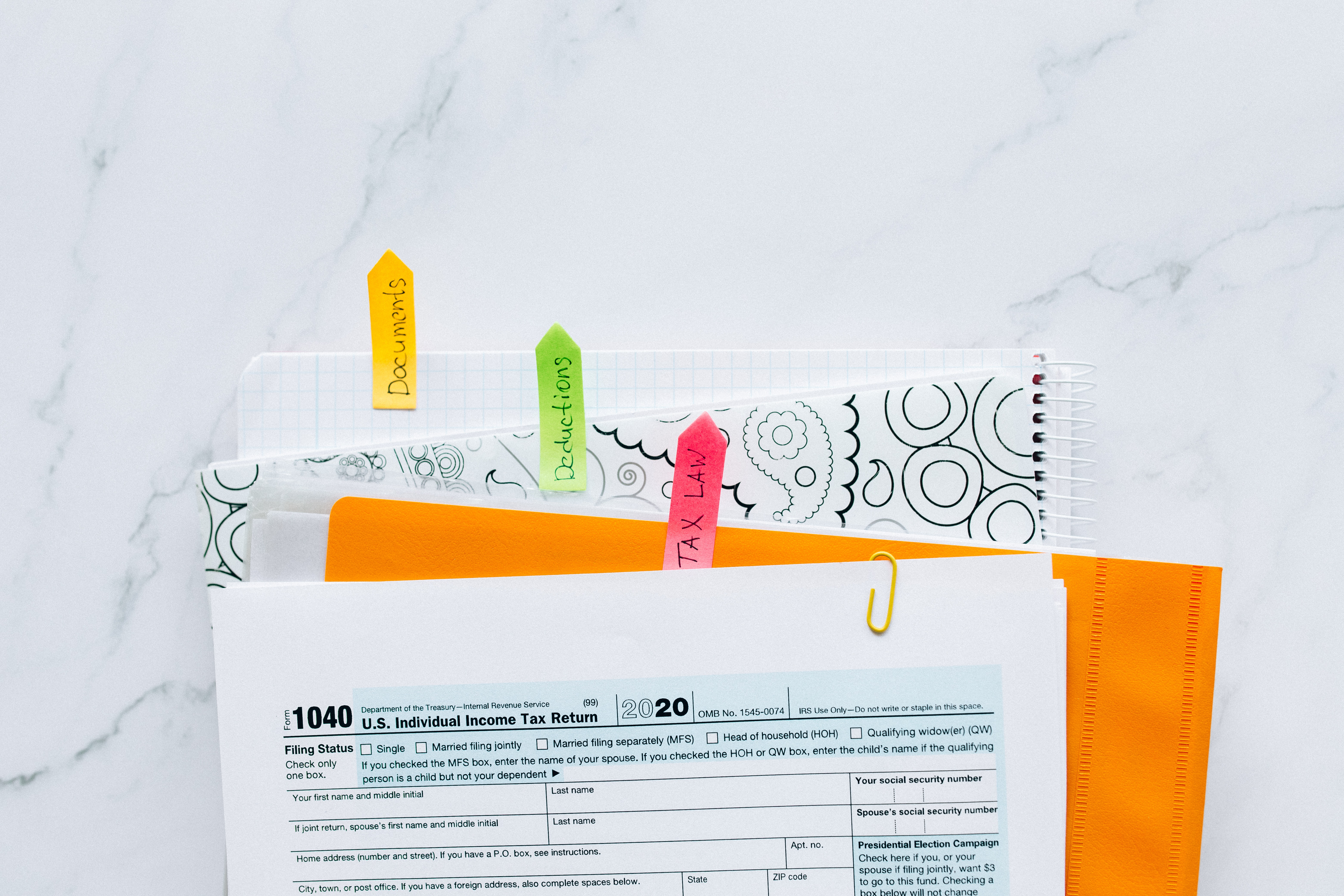

You have probably been hearing a lot of talk about possible tax law changes lately. Considering all the changes that we’ve had over the last two years, this year may be as important as ever for good tax planning, especially with the likelihood of future tax rates...

by Cassie Senter | Aug 16, 2021 | Accounting, Government, Internal Revenue Service, Tax

Getting your tax documents together to send to your tax preparer can be overwhelming, but we can help! One of the most common questions we are often asked is, “What documents are needed for individual tax returns?”. Below is a list of some basic...

by Matthew Senter | Jun 24, 2021 | Internal Revenue Service, Tax

Next month, the IRS will begin distributing the 2021 monthly advance payments for the enhanced Child Tax Credit (CTC) to eligible taxpayers. Due to the intricacies and unintended consequences that will potentially arise, some parents may want to consider opting out of...

by Matthew Senter | Jun 16, 2021 | Tax

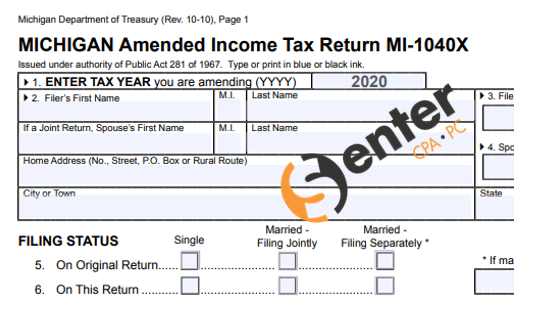

On March 11, 2021, The American Rescue Plan Act included a provision to exclude $10,200 of unemployment compensation from taxable income if the taxpayer’s modified AGI was $150,000 or less. On April 1st, the State of Michigan notified taxpayers that they would...

by Robin Scrace | May 21, 2021 | Internal Revenue Service, Tax

It is important to file your income tax returns and pay any taxes that you owe, on time. The fees and interest will continue to accumulate until your balance is fully paid. If you didn’t file your taxes by the deadline, the penalties will be much higher than if...