by Josh Legant | Dec 20, 2022 | Accounting, Courses, Internal Revenue Service, Tax

The end of the year is rapidly approaching. If you are wondering if it is necessary to issue 1099’s, then let us help you determine that. We have listed some common questions and answers related to 1099’s. What is a 1099? This is a form issued to a...

by Josh Legant | Nov 30, 2022 | Accounting, Courses, Internal Revenue Service, Tax

There are many people who may have question regarding the Employee Retention Credit (ERC) that became available for businesses during the Covid-19 pandemic. Below is a helpful article to decifer the facts about the ERC. As always, Senter, CPA is here to help. If you...

by Josh Legant | Nov 8, 2022 | Tax

It is nearing the end of the year. It is perfect time to assess your tax situation for the coming years tax return. Considering the current state of the economy/market, this year may be as important as ever for good tax planning. While we don’t know how 2022 will end...

by Lisa Haiss | Sep 26, 2022 | Accounting, Information Technology, Tax

Automatically Track mileage in QuickBooks Online This article is all about how to record business miles for one or more vehicles. You are able to record all your business miles and vehicle expenses in QuickBooks allowing you to have everything you need to calculate...

by Robin Scrace | Mar 25, 2022 | Internal Revenue Service, Tax

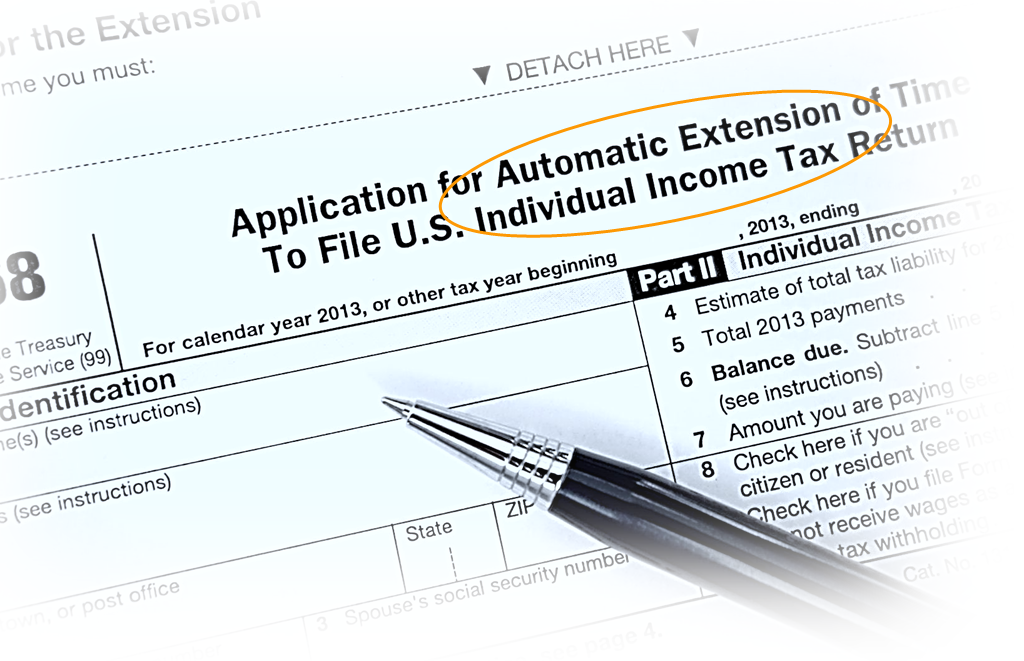

What Is a Tax Extension? A tax extension simply gives you extra time to file your taxes, six extra months to be exact. If you request an extension, it will be granted automatically, but the extension form 4868 must be filed no later than midnight on April 18th....

by Rosemary Shamoon | Mar 11, 2022 | Internal Revenue Service, Tax

Key Filing Dates There are several important dates taxpayers should keep in mind for this year’s filing season: January 14th IRS Free File opens. Taxpayers can begin filing returns through IRS Free File partners; tax returns will be transmitted to the IRS...