by Kelly Thompson | Nov 22, 2024 | Accounting, Courses, Information Technology

Quickbooks Online has recently started to offer a Bookmark feature where any page that has the left navigation bar available (ie. Reconcile, Chart of Accounts, Invoices,…) can now be saved directly to the left column of your QBO home screen with any name you’d prefer....

by Kelly Thompson | Mar 7, 2023 | Accounting, Courses, Information Technology

Intuit constantly updates their system to provide their clients with the most up-to-date and efficient program possible. We’re proud to share their 2023 updates with our clients. What’s New? Migration: Moving from QB Desktop to QB Online Migration now helps provide...

by Lisa Haiss | Feb 2, 2023 | Courses, Internal Revenue Service, Tax

Federal and State income tax payments can be made online. You can pay your state and federal income tax online, by phone, or with your mobile device using the IRS2Go app. Below are a list of links to make payments or to download the IRS2Go app. United States...

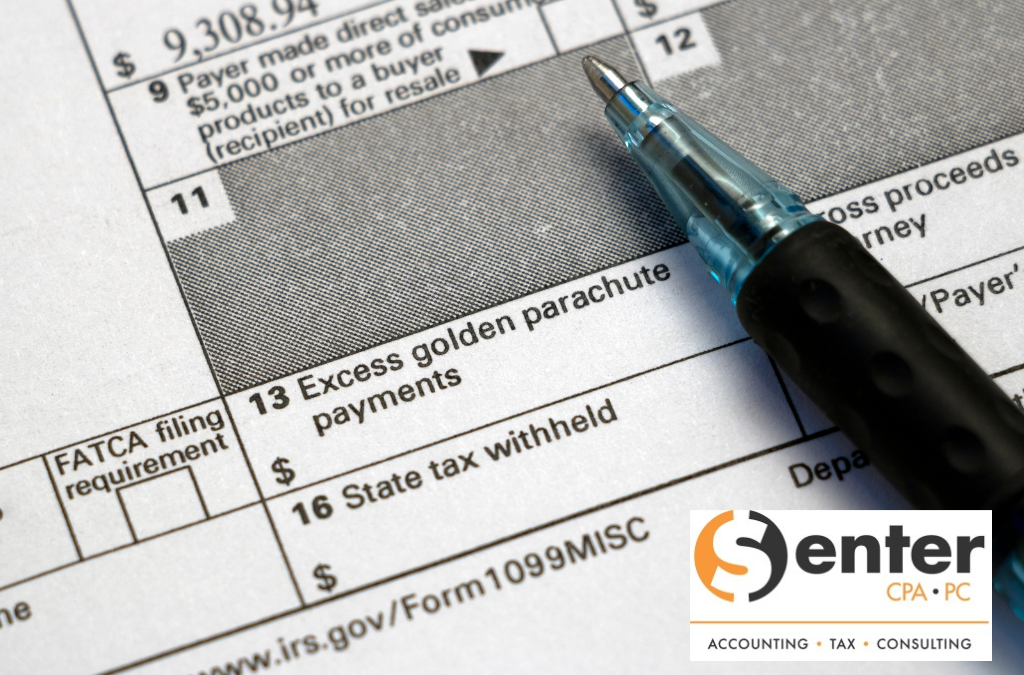

by Josh Legant | Dec 20, 2022 | Accounting, Courses, Internal Revenue Service, Tax

The end of the year is rapidly approaching. If you are wondering if it is necessary to issue 1099’s, then let us help you determine that. We have listed some common questions and answers related to 1099’s. What is a 1099? This is a form issued to a...

by Josh Legant | Nov 30, 2022 | Accounting, Courses, Internal Revenue Service, Tax

There are many people who may have question regarding the Employee Retention Credit (ERC) that became available for businesses during the Covid-19 pandemic. Below is a helpful article to decifer the facts about the ERC. As always, Senter, CPA is here to help. If you...

by Lisa Haiss | Oct 31, 2022 | Accounting, Courses, Information Technology

The Chart of Accounts is the hub of all your accounting. It is the central place where you decide how you organize your transactions. Every account or category you use in QuickBooks for every transaction comes from the Chart of Accounts. Watch the video below to learn...