by Matthew Senter | Dec 28, 2022 | Accounting, Community, Team

What a wild ride 2022 has been! Here at Senter, CPA we had an incredible 2022. We spent the year assisting clients, continuing to contribute to our communities, and growing our team. We have added two full time TEAM members who have greatly strengthened our service...

by Matthew Senter | Nov 24, 2022 | Community, Team

Happy Thanksgiving to all Senter, CPA, P.C. clients, team, friends, and community. Since today is Thanksgiving, I wanted to share a few things that, myself and the rest of the Senter CPA team, are thankful for: Our wonderful clients for trusting in us and being such...

by Matthew Senter | Nov 1, 2022 | Community, Team

To our valued clients & friends, What a tax year this has been! With all the changes to current tax laws and the tax and accounting industry it definitely keeps things interesting. We speak with CPA’s, firm owners and other business professionals who all strive to...

by Matthew Senter | Jun 14, 2022 | Community

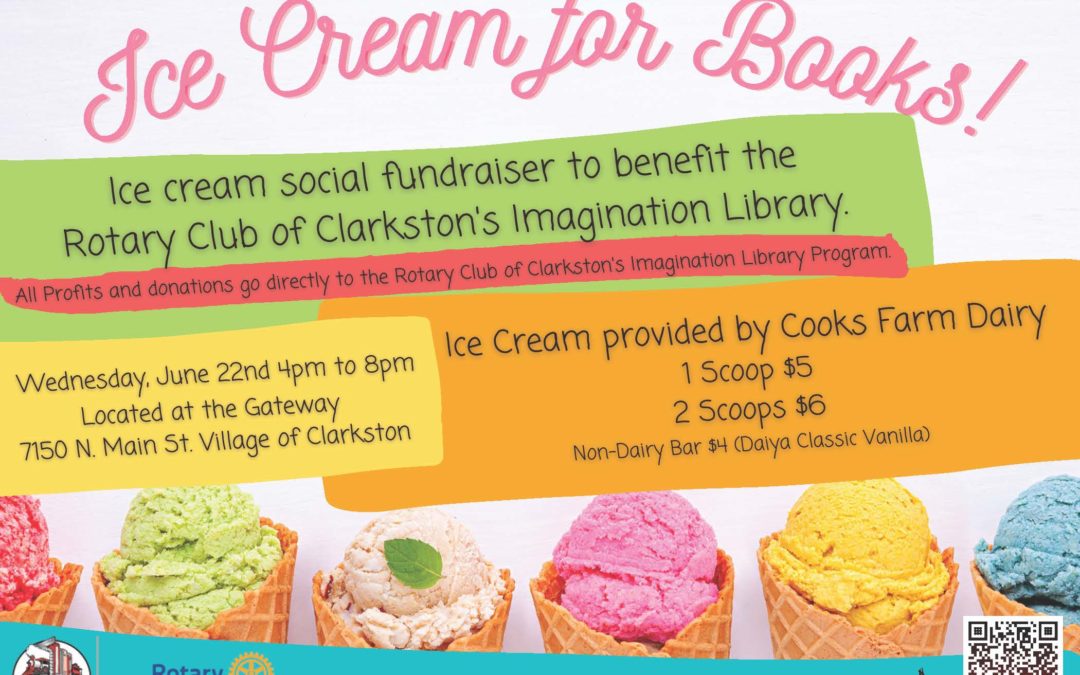

Please join us for ice cream as we raise money to support our Dolly Parton’s Imagination Library right here in Clarkston sponsored by the Rotary Club of Clarkston. Each child under 5 in a Clarkston zip code is eligible to receive a FREE book each month. When: June...

by Matthew Senter | Apr 22, 2022 | Team

OUR FIRM We are a full-service CPA firm providing tax, accounting and consulting services in Southeastern, Michigan and across the US. We offer a fun work environment and client service atmosphere. We are looking for a driven, detail oriented professional with a...