Hey folks! Want to stay up-to-date on all things Senter, CPA? Then we would like to personally invite you to subscribe to our monthly newsletter.

Once a month we prepare and send a newsletter to our clients, friends and colleagues. Most of the content is drawn from Senter, CPA’s blog, and is intended to:

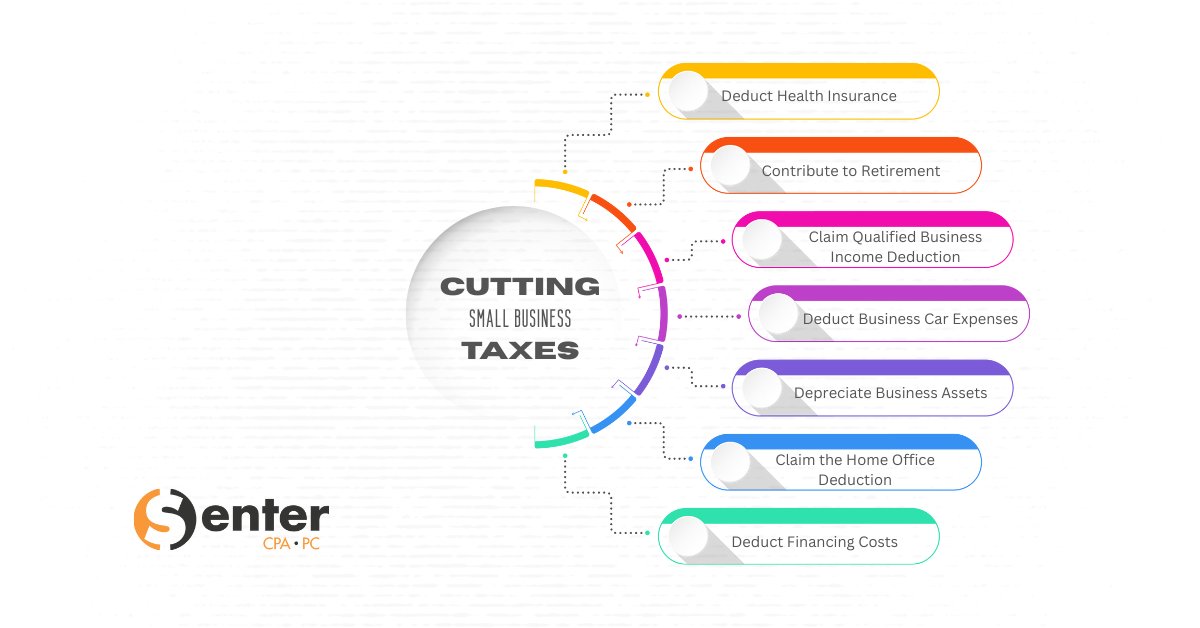

- Alert you of major changes in tax laws.

- Keep you informed of any tax or accounting updates.

- Answer common questions.

- Provide helpful insights.

- Relieve some of the stress when it comes to handling your personal and business taxes and accounting.

- Assist with navigating the client portal.

- Or simply give you a friendly update on what’s going on with our team and our families.

Not only do we like to keep our clients, friends, and colleagues informed of all things going on here at Senter, CPA, but our newsletter is also the most effective way for us to quickly inform ALL associated with us of important matters pertaining to the tax and accounting industry. Sometimes important matters come up and we need to reach all of our following, and the easiest way to do so is through our newsletter.

Our intention is not to overwhelm your inbox, nor spam you, but we sincerely desire to deliver content to you that we believe is of value.

We sincerely hope you find value in the information we share. It takes a lot of work and we take a lot of pride in things we do outside of the tax and accounting world.

To subscribe, simply enter your email and name below, then click “Subscribe”!