by Robin Scrace | Feb 14, 2022 | Community, Internal Revenue Service, Tax

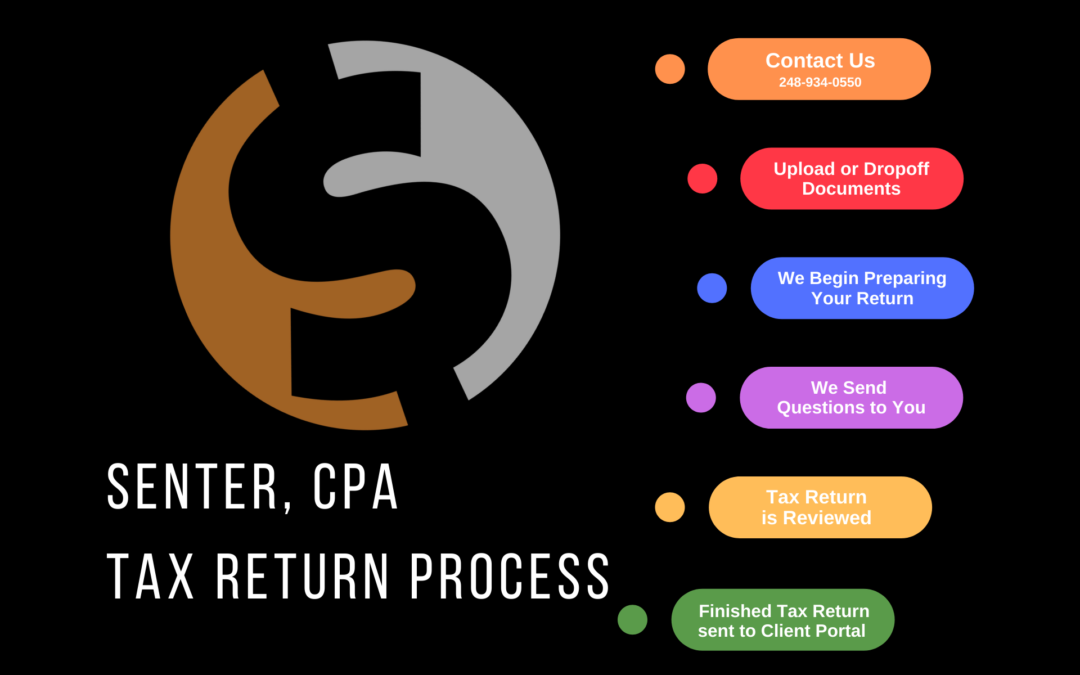

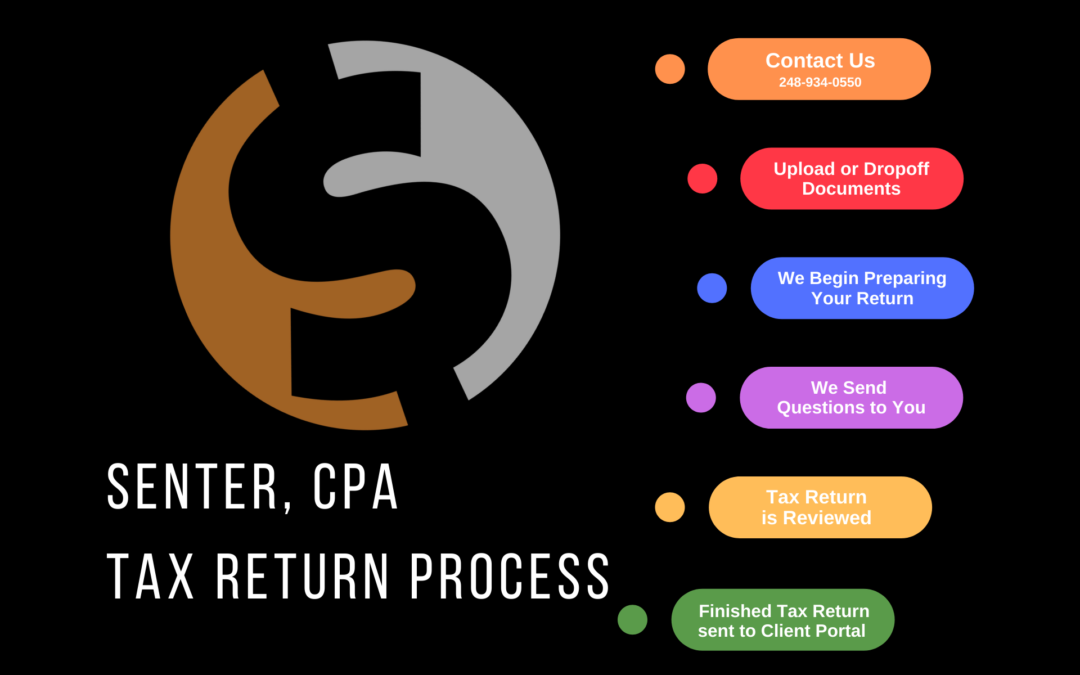

How Our Process Works Step 1: Contact Us Telephone: 248-934-0550 Use our online contact Form: HERE (or use the contact form below) Step 2: Upload Your Documents to Our Secure Portal A meeting isn’t required for us to prepare you taxes. Once you decide that...

by Rosemary Shamoon | Dec 9, 2021 | Tax

HOW DOES MARRIAGE AFFECT YOUR TAXES? Tax brackets are different for each filing status. When you get married and file a joint return, your income is combined with your spouse’s and may no longer be taxed at the same rate as when you were single. When you get...

by Matthew Senter | Nov 16, 2021 | Internal Revenue Service, Tax

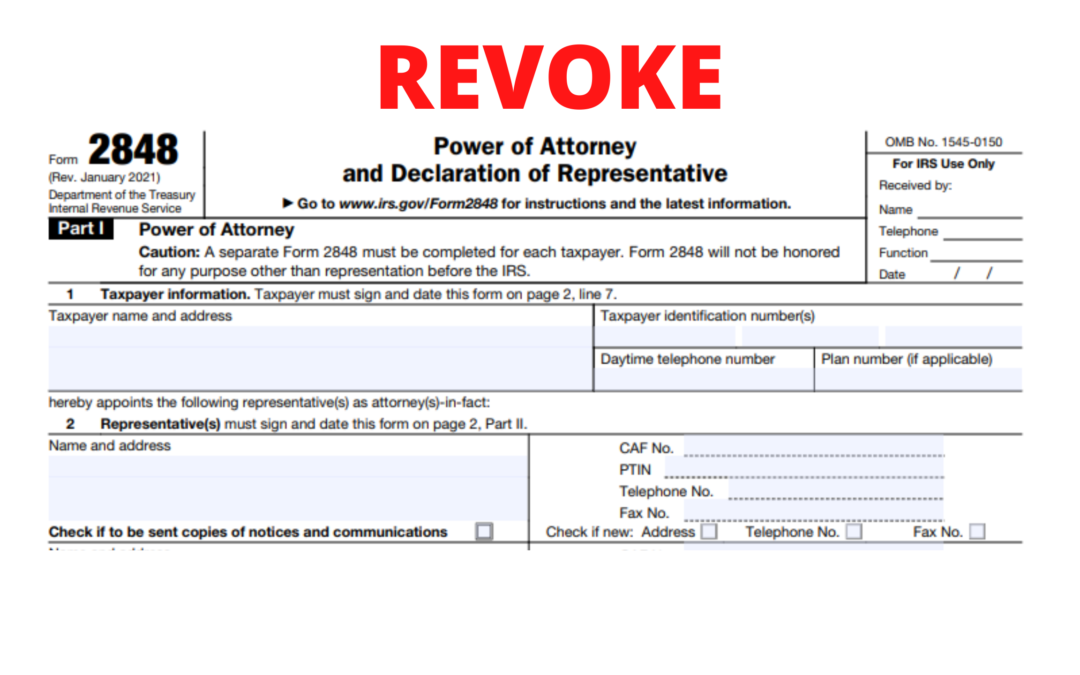

In our last blog post we walked you through how to submit a Power of Attorney online. If you missed it, you can catch up here: Submitting Power of Attorneys and Tax Information Online But, what if you’re no longer satisfied with your current representative? Or,...

by Matthew Senter | Sep 3, 2021 | Tax

You have probably been hearing a lot of talk about possible tax law changes lately. Considering all the changes that we’ve had over the last two years, this year may be as important as ever for good tax planning, especially with the likelihood of future tax rates...

by Matthew Senter | Jun 24, 2021 | Internal Revenue Service, Tax

Next month, the IRS will begin distributing the 2021 monthly advance payments for the enhanced Child Tax Credit (CTC) to eligible taxpayers. Due to the intricacies and unintended consequences that will potentially arise, some parents may want to consider opting out of...