by Lisa Haiss | Jun 12, 2023 | Tax

Extension Deadline and More The tax filing deadline was April 18th. It is now behind us, but there are a few deadline that you, as a taxpayer, need to be aware of. These deadline apply to individual’s that make estimated payments or have filed a tax extension. each...

by Lisa Haiss | May 24, 2023 | Information Technology

Register your Portal If you are a new client or new to the Onvio Client Portal, then this video is for you. You should have received a registration email from Senter, CPA P.C. to begin registering for your secure client portal. If you did not receive an email, first...

by Kelly Thompson | May 22, 2023 | Accounting

Inside the Bank Feeds in Quickbooks Online, there is a new Categorization History feature where you can see your most used and last used coded accounts. To access this new feature: go to your Banking screen select a transaction at the bottom of that expanded...

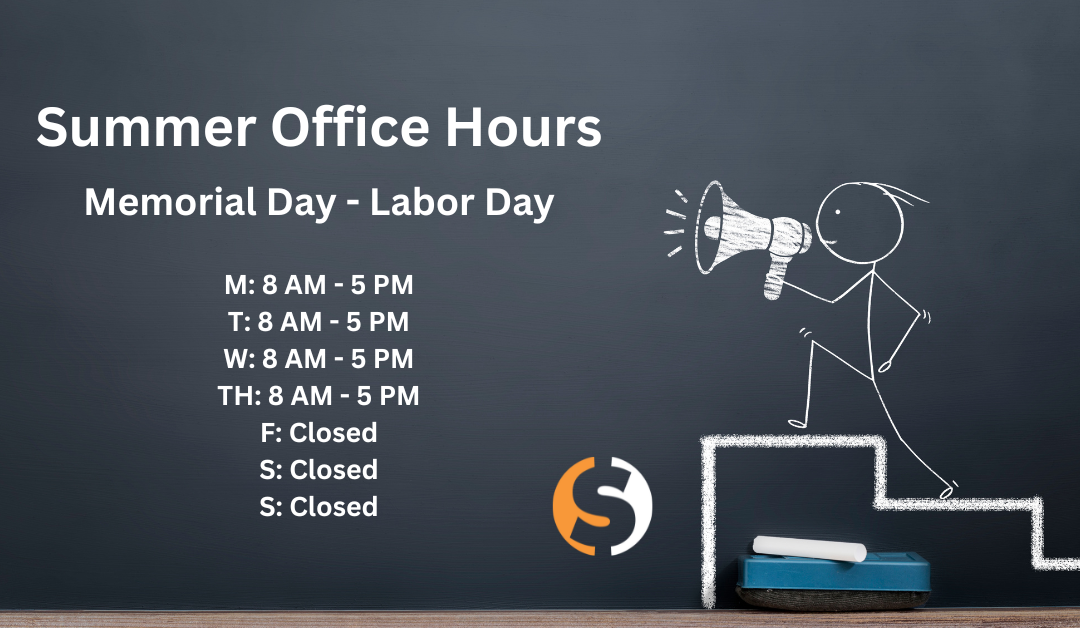

by Lisa Haiss | May 9, 2023 | Team

New Summer Hours Our new summer hours will go into effect from Memorial Day through Labor Day. We will be closed on Friday during that time. Our new hours will be: Monday 8AM – 5 PM Tuesday 8 AM – 5 PM Wednesday 8 AM – 5 PM Thursday 8 AM – 5 PM...

by Matthew Senter | May 1, 2023 | Tax

Did you know Michigan has a new tax rate for 2023? Michigan does an annual review comparing percent increase in revenue and inflation. If Revenue exceeds Inflation, there is a calculation to determine a reduction in tax rate. This year that calculation resulted in a...