by Matthew Senter | Oct 21, 2020 | Accounting, Information Technology

Let’s face it we all want faster, better and more efficient results. Especially when it comes to bookkeeping and accounting. We may not like the term “artificial intelligence,” but with the advancement of technology, it has greatly helped small business owners and the...

by Kylie Harig | Oct 13, 2020 | Accounting, Internal Revenue Service

The Most Common (& Expensive) Bookkeeping Mistakes: Incorrect Payroll Reporting: If you currently have employees and/or plan on having them in the future, then you will need to become very familiar with payroll taxes, inclusive of the various tax forms and...

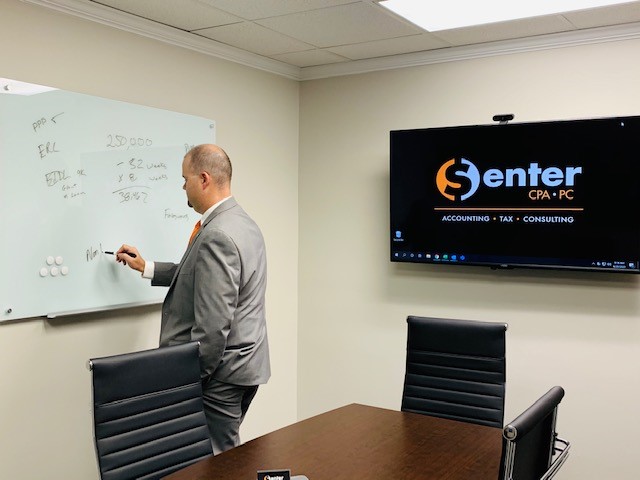

by Matthew Senter | Oct 5, 2020 | Accounting

As part of the client accounting services we provide, Senter CPA requests access to certain bank information to help ensure timely and accurate reports. As such, obtaining what we call accountants access helps us save time performing services and thus saving our...

by Kylie Harig | Sep 25, 2020 | Accounting, Community, Internal Revenue Service, Tax

As tax and accounting professionals in the financial industry, we here at Senter CPA recieve lots of questions during our client consultations and reviews. Providing thoughtful advice taylored specifically to our client is our expertise. We take much pride in...

by Matthew Senter | Sep 9, 2020 | Tax

Tax planning is the process of managing your financial plan with the goal of reducing your tax liability and safeguarding assets at the federal and state level. Most tax planning involves deductions, credits and current vs. future tax rates. When tax planning, you...