by Tracy Sanda | Feb 10, 2026 | Internal Revenue Service, Tax

Vehicle expenses can be a valuable tax deduction, but only when mileage is properly classified and documented. For tax purposes, the deductibility of mileage depends on whether the travel is considered business, commuting, or personal. Understanding these distinctions...

by Tracy Sanda | Jan 26, 2026 | Internal Revenue Service, Tax

Accurate documentation is essential when claiming charitable contributions on your tax return. The IRS requires specific records depending on the type and value of your donations. Maintaining proper records ensures your contributions are deductible and helps you avoid...

by Matthew Senter | Jan 23, 2026 | Accounting, Tax

Making Your Federal & State Income Tax Payments (updated January 2026) Paying federal and Michigan income taxes is pretty straightforward and are now required to be paid online. Below is the current list of ways to pay, plus a few tips to avoid mistakes and fees....

by Lisa Haiss | Jan 22, 2026 | Tax, Team

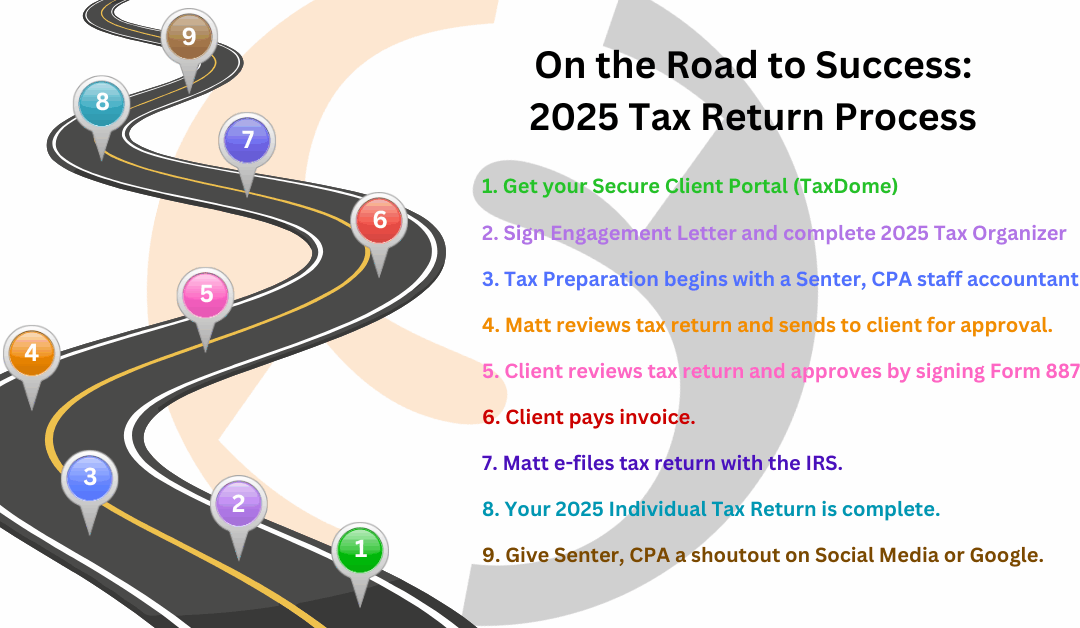

Tax Return Process At Senter, CPA, our goal is to make your tax preparation experience as seamless and efficient as possible. As we dive into the 2026 tax season, we’ve refined our process (and software) to better support accuracy, timeliness, and peace of mind. Below...

by Tracy Sanda | Jan 20, 2026 | Internal Revenue Service, Tax

Qualified Charitable Distributions (QCDs) are a tax-efficient way for eligible IRA owners to support charitable organizations while managing taxable income. Individuals who are age 70½ or older may donate up to $108,000 in 2025 directly from a traditional IRA to a...