The team at Senter, CPA, P.C. is ready to kick of the new tax season. Any of last year’s clients will receive an email with the subject “Tax Year 2023 Organizer Documents to Sign”.

If it is your intention to have Senter, CPA provide tax preparation services for the 2023 tax season, you must sign your Engagement Letter.

What you need to know before you start:

- Do NOT use your cell phone to complete the signing of your Engagement Letter.

- If you are married, filing jointly, each spouse will receive an email. You will both need to sign the Engagement Letter to show that it is complete in our system.

- When you verify your identity using the last 4 digits of your social security number, please be cautious. If you make an error, we will have to manually send the engagement letter for signature.

- The form is not considered signed until you have clicked SUBMIT and received the Thank You message.

Below is a step-by-step guide on how to complete your Engagement Letter Signature.

1. In the body of the email, click the blue “REVIEW & SIGN” button

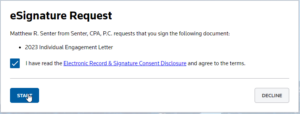

2. Check the box and click “START”

3. Verify your identity by entering the last 4 digits of your Social Security Number.

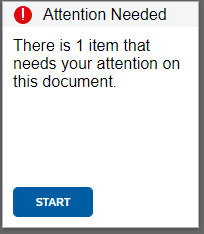

4. The Engagement Letter will open for your review. You can scroll through and read the Engagement Letter. When you are ready to sign, Click START.

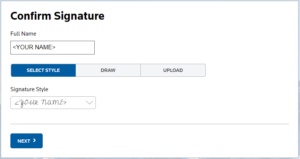

5. Your name with pre-populate. Use the drop-down to choose your style. Click NEXT.

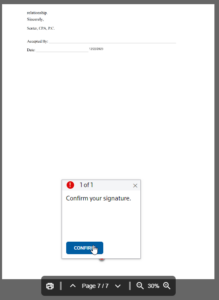

6. Confirm your signature by clicking CONFIRM.

7. You MUST click SUBMIT in the lower left corner to complete your engagement letter.

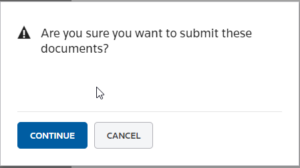

8. The system will double-check you want to submit. Click CONTINUE.

You have now completed the signature requirement of the Engagement Letter. A Thank You message will appear.

Please, feel free to reach out to us with any questions. We can be reached at (248) 934-0550. Or you can contact below.