Did you know that a taxpayer must report certain foreign financial accounts, such as bank accounts, brokerage accounts and mutual funds each year, as part of the Bank Secrecy Act?

By filing a Report of Foreign Bank and Financial Accounts, otherwise known as FBAR (on FinCEN Form 114), to the IRS, you are ensuring that delinquencies are kept to a minimum while maximizing the accuracy of your annual reporting to the U.S. Federal Government.

Does This Apply to Me?

If you are a United States person, including a citizen, resident, corporation, partnership, limited liability company, trust and/or estate, then you must file an FBAR.

The FBAR will report the following to the IRS:

- A financial interest in or signature or other authority over at least one financial account located outside the United States if

- The aggregate value of those foreign financial accounts exceeded $10,000 at any time during the calendar year reported.

Accounts that are held at a financial institution, located outside the United States, are foreign financial accounts.

What Account Types are Excluded from the FBAR?

Foreign financial accounts that are correspondent, owned by a government entity, owned by an international financial institution, U.S. Military banking facility, held in a retirement account (including an IRA) or a trust in which you are the beneficiary do not need to be reported annually to the IRS.

What is the Deadline to file an FBAR?

The FBAR is due April 15 following of each calendar year. However, you don’t need to request an extension to file, as you are allowed a free automatic extension until October 15, if you miss the April 15 deadline.

How do I File the FBAR?

You must file the FBAR electronically through the Financial Crimes Enforcement Network’s BSA E-Filing System.

FBAR Record Keeping 101:

The IRS requires you to keep records for five years from the due date of the filing.

Unsure what to archive? Maintaining records for each account required to be reported to the IRS is mandatory. Documentation that provides account specific information such as names on the account, account number, name/address of the financial institution, type of account and the maximum value for the year in each account is crucial.

What Penalties Exist for Delinquency?

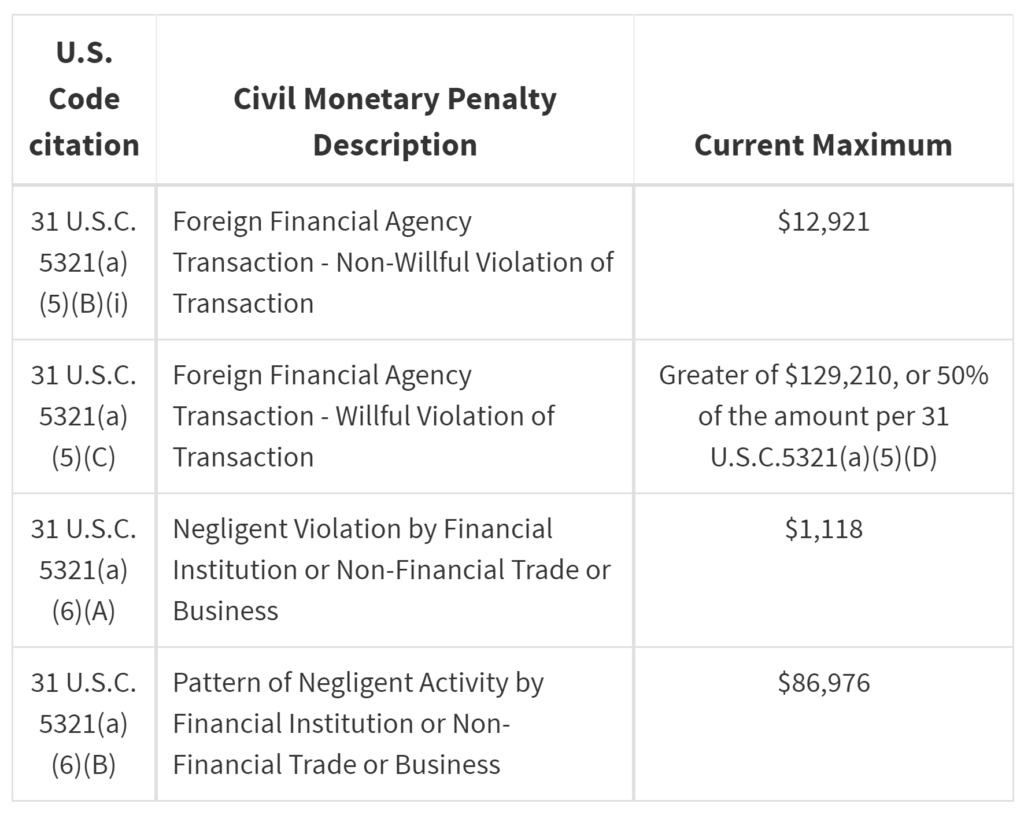

Filing an FBAR late or not at all is a violation with the IRS and may subject you to penalties, including civil monetary penalties and/or criminal penalties.

Current maximums, per the IRS, are as follows:

You may file late FBARs if you have not been contacted by the IRS about delinquency and are not under civil or criminal investigation by IRS.

Resources (click the links below)

If you have any questions in regards to your situation, applicability or delinquent filing, please contact us HERE or give us a call at 248-934-0550.