by Josh Legant | May 30, 2024 | Tax

The April 15th deadline is behind us. At this point, some of you may want to think about your 2024 finances and tax return. That being the case, for many of you, that would include taking a retirement distribution from your retirement accounts. If you think that you...

by Josh Legant | Feb 28, 2024 | Tax

It is not uncommon to have a need for more time to prepare your federal tax return. This post provides valuable information on how to apply for an extension of time to file. Please be aware that: An extension of time to file your return does not grant you any...

by Josh Legant | Feb 13, 2024 | Tax

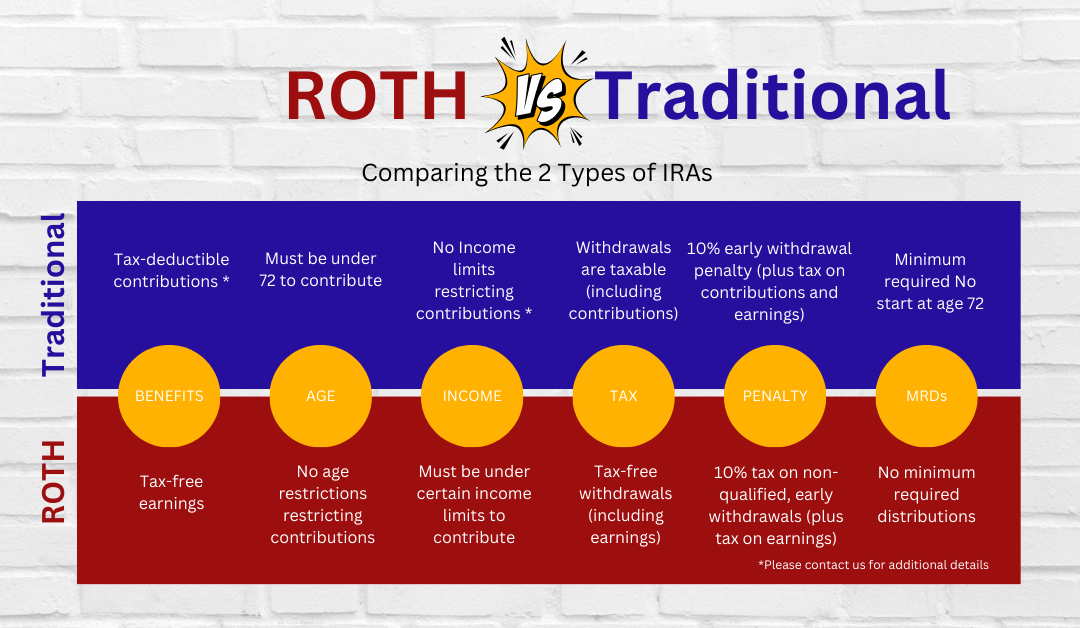

Saving for retirement can be a daunting task. Here, at Senter CPA, we can help you make some of those retirement decisions. One of those being the decision to put money into a Traditional retirement account or a Roth account. Everyone has a different tax situation...

by Josh Legant | Jan 23, 2024 | Tax

Getting your tax documents together to send to your tax preparer can be overwhelming, but we can help! One of the most common questions we are asked is, “What documents are needed for individual tax returns?”. Below is a list of some basic information your tax...

by Josh Legant | Dec 12, 2023 | Tax

The end of the year is rapidly approaching. If you are wondering if it is necessary to issue 1099’s, then let us help you determine that. We have listed some common questions and answers related to 1099’s. What is a 1099? This is a form issued to a...