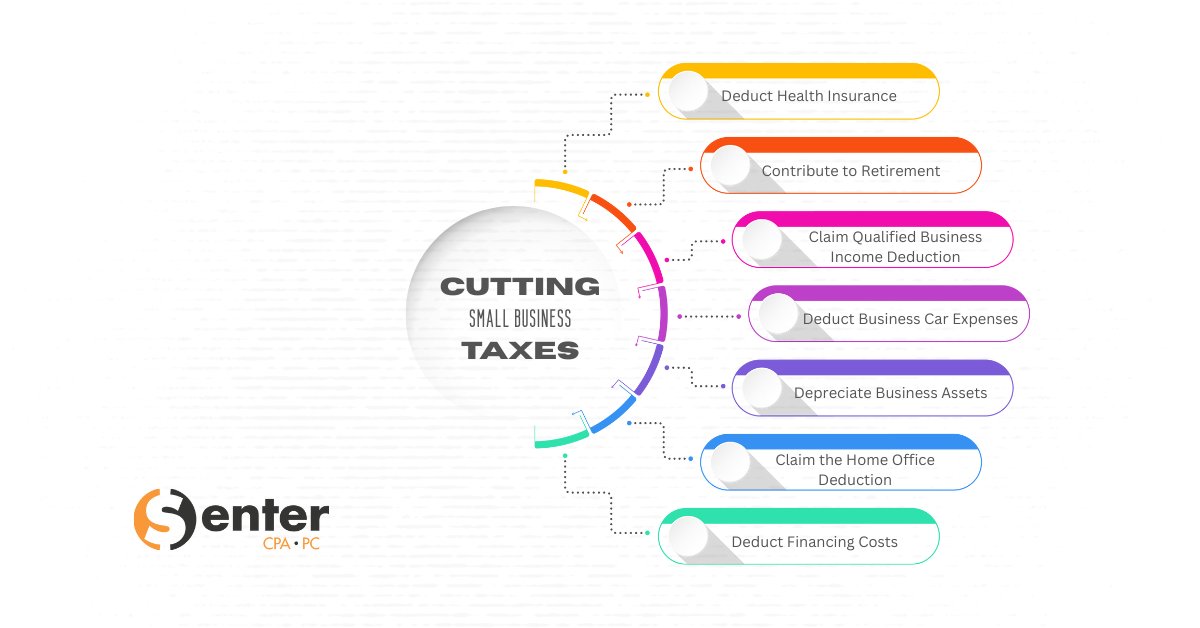

7 Effective Ways to Lower Your Tax Bill as a Small Business Owner

Running a small business means balancing many tasks. While your primary focus is likely on day-to-day operations, it’s important to also consider strategies that can help reduce your tax burden. By taking advantage of popular tax deductions, you can save money and reinvest it into your business. Here are seven strategies to lower your tax bill:

- Deduct Health Insurance Costs

Health insurance can be expensive, but as a self-employed person, you may be eligible for tax deductions. If you pay for your own health insurance and don’t have coverage through a spouse, you can claim the self-employed health insurance deduction. This allows you to deduct premiums for medical, dental, vision, and long-term care insurance, potentially reducing your tax bill. This deduction can also be extended to your spouse and any qualifying dependents under 26.

- Contribute to Retirement Accounts

As a business owner, you have several retirement savings options with tax benefits. If you’re self-employed without employees, consider a Solo 401(k), which allows you to contribute up to 100% of your income as an employee (with an annual limit). For 2024, this means you can contribute up to $69,000 (plus an additional $7,500 if you’re over 50). Alternatively, a SEP IRA allows contributions of up to 25% of your income, with similar limits. Contributions to these accounts can reduce your taxable income and may make you eligible for the Saver’s Credit, worth up to $2,000 for married couples.

- Claim the Qualified Business Income Deduction

The Qualified Business Income (QBI) Deduction lets eligible small business owners deduct up to 20% of their business income. This deduction applies to sole proprietorships, partnerships, LLCs, and S corporations. To qualify, your taxable income must be below $191,950 for single filers or $383,900 for joint filers in 2024. Certain service businesses, like law and medicine, have additional limitations.

- Deduct Business Car Expenses

If you use your vehicle for business purposes, you can deduct related expenses. There are two ways to calculate this deduction:

- Standard Mileage Rate: Deduct a fixed amount per mile driven for business. In 2024, the rate is 67 cents per mile.

- Actual Expenses: Deduct a portion of actual expenses like gas, maintenance, and insurance, based on the percentage of time the car is used for business. Track your mileage carefully to ensure you only deduct business-related miles.

- Depreciate Business Assets

Over time, assets like equipment and vehicles lose value, and the IRS allows you to deduct depreciation. Here are a few options:

- Section 179 Deduction: Deduct the full cost of qualifying assets (up to $1,220,000 in 2024) in the first year they are placed into service.

- Bonus Depreciation: Deduct a large portion of the cost of qualifying equipment, with 60% of the purchase price eligible for deduction in 2024.

- MACRS Depreciation: Accelerate deductions in the early years of an asset’s life, reducing your taxable income now. Luxury vehicles have specific limits for first-year depreciation, so be mindful when claiming deductions for them.

- Claim the Home Office Deduction

If you use part of your home exclusively for business, you may qualify for the home office deduction. To qualify, the space must be used regularly and exclusively for business activities and be your principal place of business or a place where you meet clients. This deduction can apply to a dedicated office, or even structures like a garage or studio, if used exclusively for business.

- Deduct Financing Costs

The IRS allows you to deduct certain financing costs, such as interest on loans, credit card charges, and other business-related credit expenses. Examples include mortgage interest on an office building, fees from business loans, and finance charges on equipment leases. Keeping track of these costs can help you maximize your deductions.

Reducing your tax bill as a small business owner requires careful tax planning and awareness of available deductions. Whether it’s health insurance, retirement contributions, or business expenses like car use and depreciation, there are multiple ways to lower your tax liability. To make the most of the deductions available to you, consider working with us to create a tax strategy tailored to your business needs.