Tax season officially starts today with the Internal Revenue Service (IRS) now accepting e-files for 2019 tax returns. Let the countdown begin: Days Remaining

Common Documents Needed (please note this is not an exhaustive list and depends on each individuals situation):

- Income documents W-2(s), 1099(s), K-1(s) etc.

- Investment income and gain or loss detail

- Business income and expense detail

- Rental income and expense detail

- Other income or loss detail

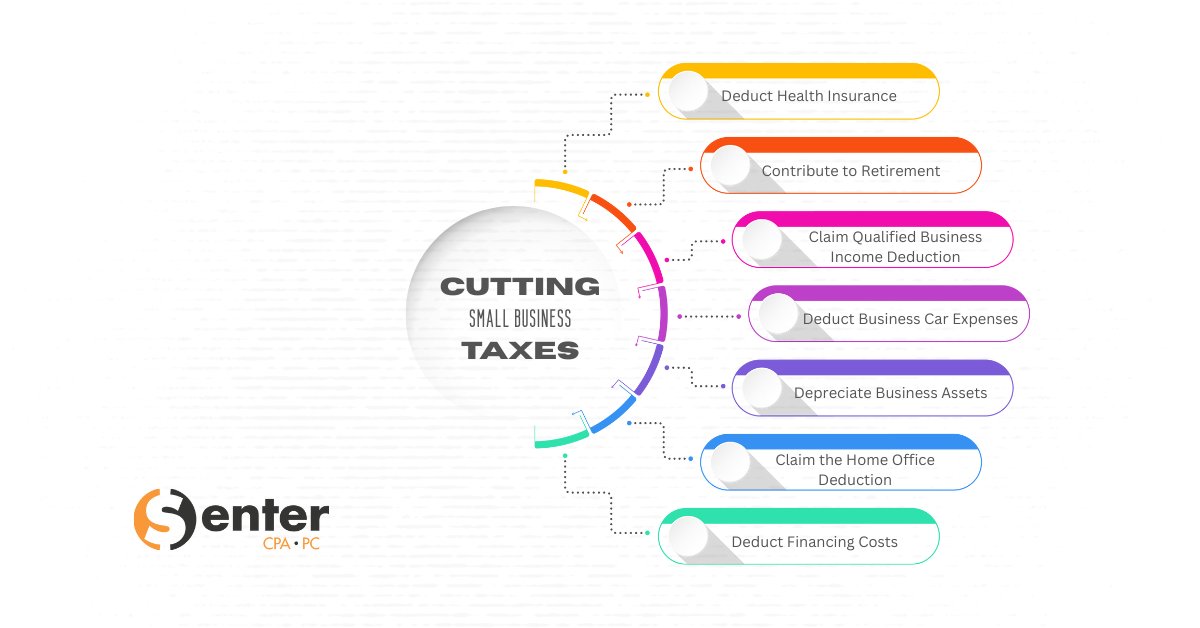

- Deductions: Mortgage 1098(s), Charitable Contribution schedule(s), State and Local Tax payment(s), Qualified Medical expenses etc.

- Summary of estimated tax payments

- Childcare expenses

- Educator expenses

- HSA and IRA contributions

A Few Notes:

- All clients we prepared 2018 tax returns for should have received an email alerting them of the tax organizer and engagement letter within the portal for 2019. You can access your portal HERE. Anyone who did not receive their tax organizer or engagement letter please let us know as soon as possible.

- Refunds usually come within 21 days of e-filed returns or 6 weeks for paper filed return.

- You can check the status of your refund HERE

- If you are a new client, we request copies of your last two tax returns with date of birth, along with copies of current year tax documents, to ensure we provide the best service possible.

- A 6 month extension to file does exist, however it doesn’t extend the time to pay.

- Anyone having issues logging into their portal due to the multi-factor authentication (MFA) code (establishing MFA onto new devices) will need to contact us with simple procedures to fix.

- Don’t wait till the last minute. The sooner we receive your information, the easier it is for us to timely prepare your return(s), and the better we are able to serve you.

Key Dates:

- February 15, 2020:

Delayed refunds sent to those who claim the earned income credit - March 16, 2020:

Partnership Income Tax Return due (Form 1065)

S Corporation Income Tax Return due (Form 1120S) - March 31, 2020:

Last day to submit documents to our firm to ensure returns are filed on time and not extended - April 15, 2020:

Individual Tax Returns due for 2019 (Form 1040)

Estate and Trust Tax Returns due for 2019 (Form 1041 & 709)

FBAR: Reports for Foreign Bank Accounts are due

Last Day to make a 2019 IRA contribution

Last Day to make a 2019 HSA contribution

1st Quarter 2020 individual estimated tax payments are due

Tax Day! Our office will be closing at 5:00 p.m. to celebrate the end of tax season at a local spot with our team and their families. - May 15, 2020:

Tax Exempt Organization Returns due (Form 990) - July 31, 2020:

Employee Benefit Returns due (Form 5500)

We Agree with AT&T: Just OK is not OK – Call us today

As always, we are very appreciative of our clients, friends and supporters. The best compliment we can receive, is a referral or recommendation to your friends, family and colleagues about our service.

A summary of our services can be found: HERE

We look forward to assisting our existing and future clients this 2020 tax season with their tax and accounting needs. If you need us we can always be reached HERE or give us a call at 248-934-0550.