Hi there! My name is Kylie Harig and I am the new office manager at Senter, CPA. I am so thankful for the opportunity to introduce myself to you and hope that you enjoy learning a little about me and my family.

I come to you with nearly a decade of experience in the financial industry. Over those years, I worked side by side with financial advisors, CPA’s, estate planning attorneys, and insurance companies to provide excellent service and expertise to our client base. I’ve proudly served as both operation and relationship managers during the course of my professional career, however my passion is the people I’ve met along the way. I’ve always enjoyed the process of establishing a client relationship and deepening it with trust, knowledge, and accountability. Exceeding our clients expectations is my goal everyday.

Prior to my years in finance, I spent time living in New Orleans, LA, working as a corporate sales consultant for a well known luxury brand. This is really where I started to understand customer service as the core of my professional development and, as a result, dedicated myself to my clients wholeheartedly.

Before I was a professional and simply had a student status, you could find me at Michigan State University, where I studied business communication. Commencement came after four (and a half) years, in 2007. I don’t get back to East Lansing as often as I would like nowadays, although I do miss game days and walking around campus. I have good reason though, because in 2013, I became a mom to a little girl named, Ellie, and really who has time for much after kids?

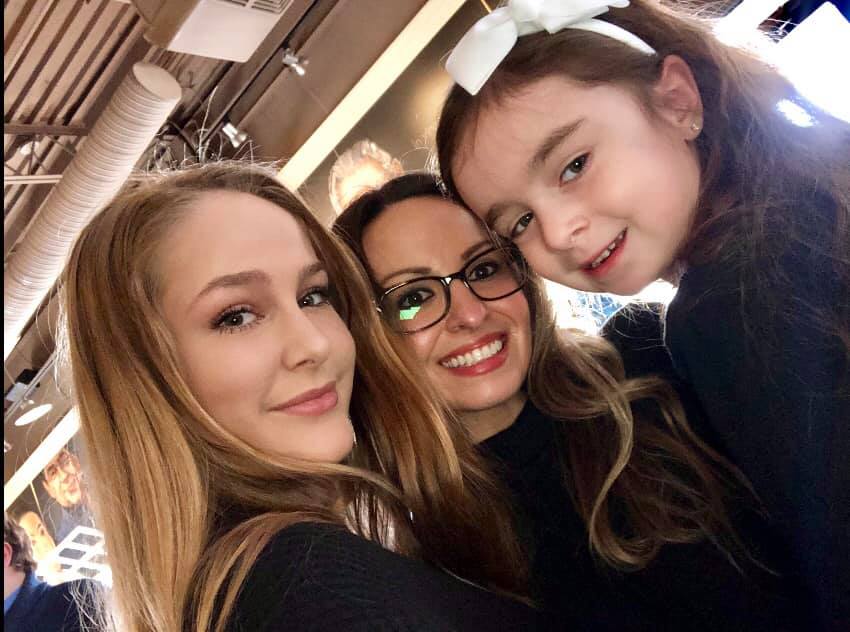

Ellie is the best part of everyday. She is smart and kind and full of joy. Most of Ellie is old soul, sometimes a little too wise for her young age. The other parts of Ellie are curious and patient, with enough confidence to keep me on my toes. I am so thankful to be her mom.

In addition to my daughter, I also have a sister, Lila, who is 16 years younger than I am. Lila is a sophomore at MSU studying engineering, earning a 4.0 every semester and making it look easy. I am so proud of her accomplishments every step of the way. Our parents live in Uzbekistan after residing in Clarkston for 20 years. Needless to say, we miss them very much, but look forward to having them home after retirement.

I’m so thankful for the opportunity to work closely with you at Senter, CPA. Please be sure to call or stop in to say hello- it would make my day!

If you ever need anything, please contact us HERE or give us a call at 248-934-0550. We are at your service.