by Matthew Senter | Dec 23, 2025 | Accounting, Tax

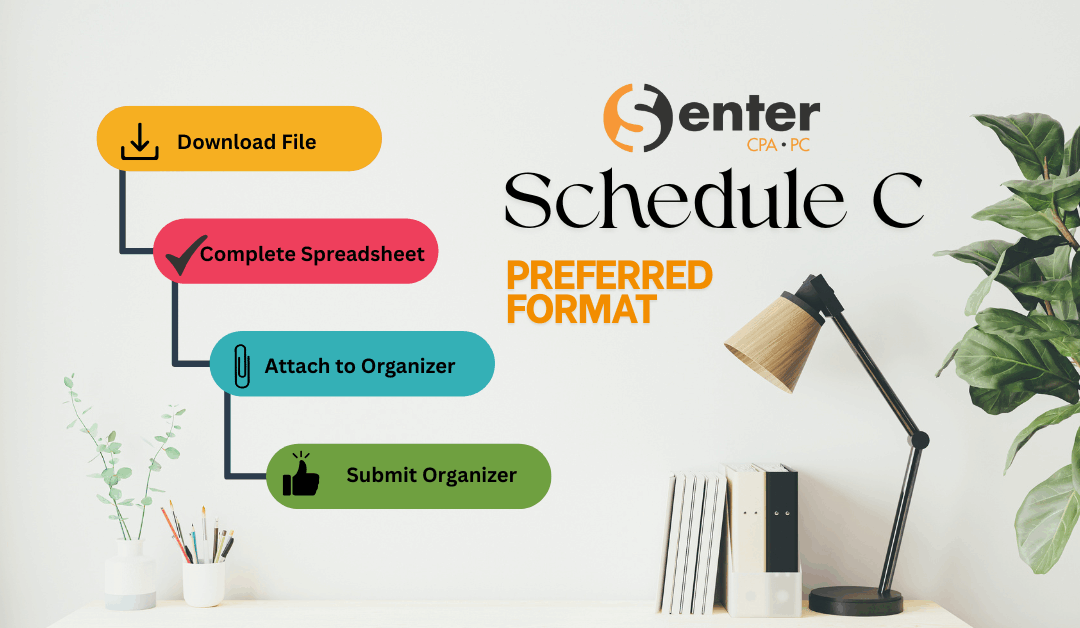

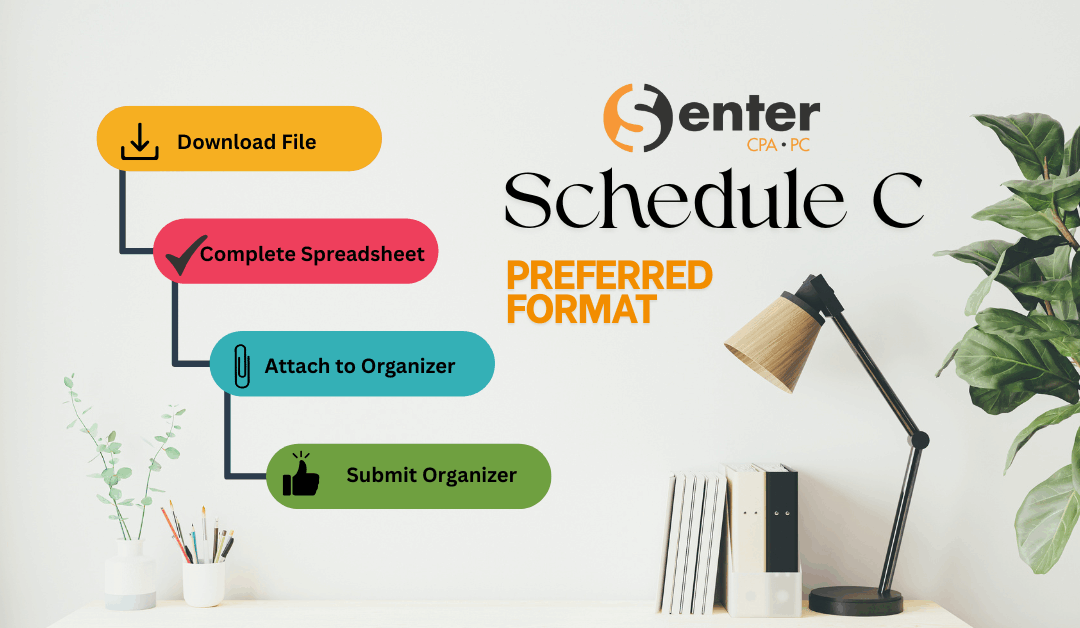

If you file Schedule C as a sole proprietor or single-member LLC, you already know how detailed the IRS can be. The form requires a thorough breakdown of your business income and expenses, leaving little room for guesswork. Schedule C is the primary IRS form used to...

by Matthew Senter | Dec 23, 2025 | Accounting, Tax

If you report rental income on Schedule E, you already know the IRS wants your numbers broken out by category and by property. Schedule E is the main IRS form used to report rental real estate income and expenses on your personal return, and clean detail makes prep...

by Matthew Senter | Dec 15, 2025 | Accounting, Tax

First off, thank you for being part of the Senter, CPA, P.C. family! Whether we helped untangle your taxes, guided your business through accounting complexities, or simply answered that one stubborn finance question that was bugging you, we hope we’ve made your...

by Tracy Sanda | Dec 1, 2025 | Accounting, Tax

New Tax Laws Affecting Social Security Benefits in 2025 Recent tax legislation has introduced changes that may impact how Social Security benefits are taxed—especially for seniors with lower to moderate incomes. While the core rules around taxation of Social Security...

by Jordan Middleton | Nov 19, 2025 | Accounting, Tax

It’s almost that time of year again — 1099 season! Before you start panicking and digging through piles of receipts, let’s go over a few quick reminders to make sure your 1099s are accurate and filed on time. What is a 1099? A 1099 form reports payments made to...