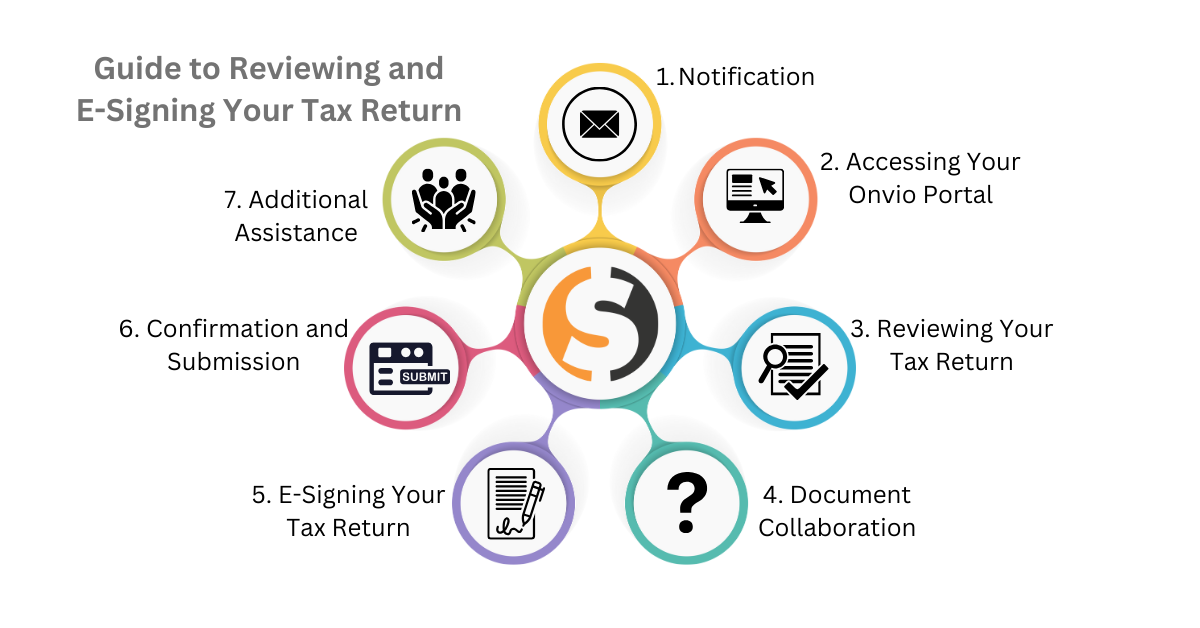

Senter CPA’s Guide to Reviewing and E-Signing Your Tax Return

As tax season approaches, we understand the importance of making the process as smooth as possible for our clients. At Senter CPA, we leverage cutting-edge technology to simplify the review and e-signing of your tax return through UltraTax and the Onvio portal. Follow this step-by-step guide to ensure a seamless experience:

Step 1: Notification

Once your tax return is completed by our TEAM, you will receive a notification via email that your return is in your Onvio portal and ready for review. This notification will prompt you to review and sign your return, initiating the next steps in the process.

Step 2: Accessing Your Onvio Portal

Log in to your Onvio portal using your credentials. Your personalized dashboard will display the relevant documents, including your completed tax return. Click on the document to access it. You will notice for those of you who are the tax matters person for others or own multiple entities there is a drop-down feather in the top left to navigate from your personal folder to others related to you.

Step 3: Reviewing Your Tax Return

Navigate through your tax return using the user-friendly interface. Onvio provides an easy-to-use layout to click and view your archived copy of the return and any action required documents making it easy to review your return comprehensively and take necessary actions such as printing vouchers to make payments or the following year estimates. Take your time to ensure all details are accurate and reflect your current income and deductions.

Step 4: Document Collaboration

Should you have any questions or require clarifications on specific items, utilize the collaboration features within Onvio, send us an email or as always give us a call. We strive for efficient communication between you and our team at Senter CPA.

Step 5: E-Signing Your Return

Once you are satisfied with the return and approve it for filing, it’s time to e-sign your tax return. Onvio offers a secure and straightforward e-signature process. Follow the prompts you received via email to electronically sign the 8879 e-file authorization, certifying the accuracy of the information provided. If you are married, filing jointly, a signature is required by both spouses.

Step 6: Confirmation and Submission

After e-signing, you will receive confirmation once returns have been accepted by the varying governmental agencies. Rest assured that your signed tax return is securely stored within your Onvio portal. Senter CPA will also receive notification of your e-signature, allowing us to proceed with filing your return with the relevant authorities.

Step 7: Additional Assistance

If you encounter any issues or have further questions during the process, our dedicated team is just a message away. Contact us through email or give us a call, and we will promptly assist you in resolving any concerns.

By following these steps, you can confidently navigate the process of reviewing and e-signing your tax return with Senter CPA. We are committed to providing a streamlined and secure experience, ensuring that your financial matters are handled with the utmost care and professionalism. Thank you for choosing Senter CPA for your tax needs.

A few helpful tips:

- The access point to your portal can always be found on our website in the top banner “Client Login” sentercpa.com

- A deeper look into our entire preparation process can be found here: https://sentercpa.com/senter-cpa-tax-return-process/

- Information regarding e-signing your engagement letter can be found here: https://sentercpa.com/signing-your-individual-1040-engagement-letter/

- Need to change your client portal email? Details can be found here: https://sentercpa.com/change-client-portal-email/ (unfortunately our software doesn’t allow us to do this from our end)

- Need to register your client portal? More on that here: https://sentercpa.com/registering-your-onvio-portal/