Welcome to our blog! Our goal with this blog is to keep our friends and clients informed about us, information relevant to you and our involvement in the community. I thought I’d share in our first post a little more about, well, ME: Matthew Senter, CPA.

My Family

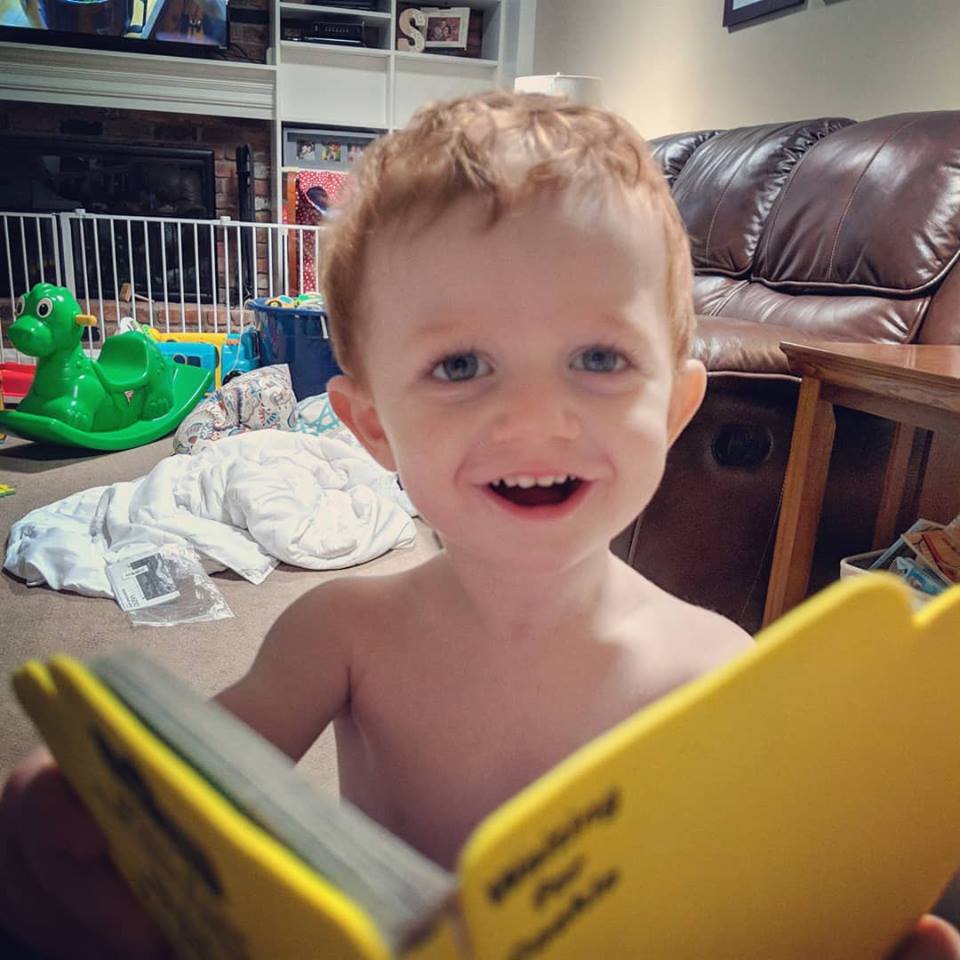

We are a family of 5 consisting of me, my beautiful wife Cassie, Ben (11), Waylon (2.5) and Charlotte (7 months). We only plan to add a dog or two in the future. Our best mug shots are below.

Fun Facts

- Name: Matthew Ryan Senter

- Nickname: Groundhog

- Born: February 25, 1986 in Columbia, Tennessee

- I grew up in a small town 45 miles south of Nashville, Tennessee called Culleoka. Known to some a “Sweetwater” but famous for the Culleoka Queen salmon colored cantaloupe

- I had approximately 65 students in my graduating class, K-12 all on one campus

- Though I received my undergrad and graduate degrees from Middle Tennessee State University I am a fan of the University of Tennessee (hence the orange you will see around our office)

- Education: Masters of Business Administration emphasis in Taxation

- Professional Certifications: Certified Public Accountant

- Favorite sport to play: baseball

- Favorite hobby: fishing

- Fear: snakes

- Music: Country

- Miss the most of about the South: food

We hope you enjoy the articles to come, find this blog useful and if there is a topic you’d like to see covered please share with us.

If you’d like to know more about me and my humble beginnings, contact Matthew Senter, CPA HERE. If you’d like to know more about our services, click HERE.