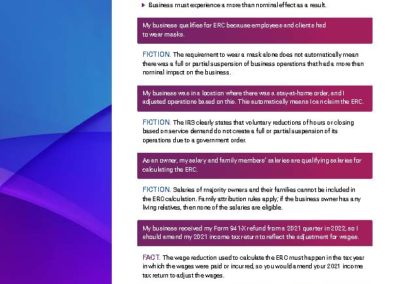

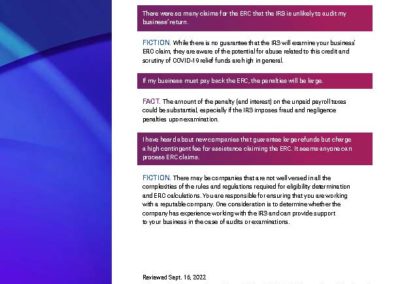

There are many people who may have question regarding the Employee Retention Credit (ERC) that became available for businesses during the Covid-19 pandemic. Below is a helpful article to decifer the facts about the ERC. As always, Senter, CPA is here to help. If you have more questions, please reach out to us.

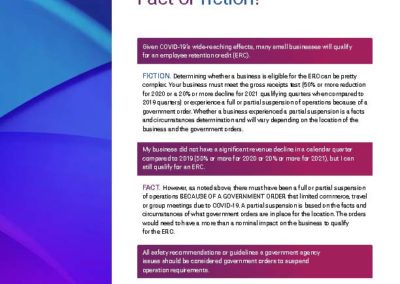

Fact or Fiction for the Employee Retention Credit (ERC)

by Josh Legant | Nov 30, 2022 | Accounting, Courses, Internal Revenue Service, Tax

Always remember, Senter, CPA is here for you if you need any assistance.

Don't hesitate to give us a call at 248-934-0550, or contact us below.

The 7 Deadly (Tax) Sins of Small Business Owners

by Jordan Middleton | February 23, 2026 | Accounting, Tax | 0 Comments

Running a business is hard enough — between serving customers, managing staff, and juggling invoices, your taxes can feel like an afterthought. But beware, small business owner: the IRS has seen it all, and a few “little” mistakes can cost you big.

What the New “No Tax on Tips” Rule Means for You

by Tracy Sanda | February 17, 2026 | Accounting, Tax | 0 Comments

The treatment of tip income is changing in 2025, thanks to the new “No Tax on Tips” provision introduced under the One Big Beautiful Bill Act (OBBBA). While tips remain taxable in several respects, eligible workers may now claim a federal income tax deduction of up to $25,000 annually for “qualified tips.”

Why QuickBooks Can’t Replace Your Accountant (Even If It Thinks It Can)

by Jordan Middleton | February 12, 2026 | Accounting, Tax | 0 Comments

Let’s face it — QuickBooks is amazing. It’s like the Swiss Army knife of bookkeeping. It tracks your income, pays your bills, and even sends friendly reminders that you forgot to reconcile your bank account… again. But while QuickBooks can do a lot, it can’t do everything — especially the things that can make or save you money. And that’s where your accountant (hi, that’s us) comes in.

Business Mileage Deductibility: What Qualifies and What Does Not

by Tracy Sanda | February 10, 2026 | Internal Revenue Service, Tax | 0 Comments

Vehicle expenses can be a valuable tax deduction, but only when mileage is properly classified and documented. For tax purposes, the deductibility of mileage depends on whether the travel is considered business, commuting, or personal. Understanding these distinctions is essential to support allowable business mileage deductions.

Welcome to the Senter, CPA Team – Shannon Currie

by Lisa Haiss | February 2, 2026 | Team | 0 Comments

Shannon is pleased to join the Senter team as a Staff Accountant.

How to Document Charitable Donations for Tax Deductions

by Tracy Sanda | January 26, 2026 | Internal Revenue Service, Tax | 0 Comments

Accurate documentation is essential when claiming charitable contributions on your tax return. The IRS requires specific records depending on the type and value of your donations. Maintaining proper records ensures your contributions are deductible and helps you avoid issues if your return is ever reviewed.

How to make Federal & State Income Tax Payments (update January 2026)

by Matthew Senter | January 23, 2026 | Accounting, Tax | 0 Comments

Paying federal and Michigan income taxes is pretty straightforward and are now required to be paid online.

2025 Individual Tax Return Process

by Lisa Haiss | January 22, 2026 | Tax, Team | 0 Comments

At Senter, CPA, our goal is to make your tax preparation experience as seamless and efficient as possible.

What are QCD’s?

by Tracy Sanda | January 20, 2026 | Internal Revenue Service, Tax | 0 Comments

Qualified Charitable Distributions (QCDs) are a tax-efficient way for eligible IRA owners to support charitable organizations while managing taxable income. Individuals who are age 70½ or older may donate up to $108,000 in 2025 directly from a traditional IRA to a qualified charity. When structured properly, a QCD is excluded from taxable income, may satisfy Required Minimum Distribution (RMD) requirements, and can help reduce overall tax liability.

Common Tax Documentation for 2025 Tax Season

by Lisa Haiss | January 13, 2026 | Internal Revenue Service, Tax | 0 Comments

Getting your tax documents organized for your preparer can feel overwhelming—but you don’t have to do it alone. One of the most common questions we hear is, “What documents do I need for my individual tax return?”