Extension Deadline and More

The tax filing deadline was April 18th. It is now behind us, but there are a few deadline that you, as a taxpayer, need to be aware of. These deadline apply to individual’s that make estimated payments or have filed a tax extension. each tax payer’s situation is different so some of these may not apply to you. If you have any questions regarding these deadlines, please call our office and we will be happy to assit.

- June 15th

- Second quarter estimated tax payments are due

- September 15th

- Third quarter estimated tax payments are due

- Extended 2022 business tax returns are due

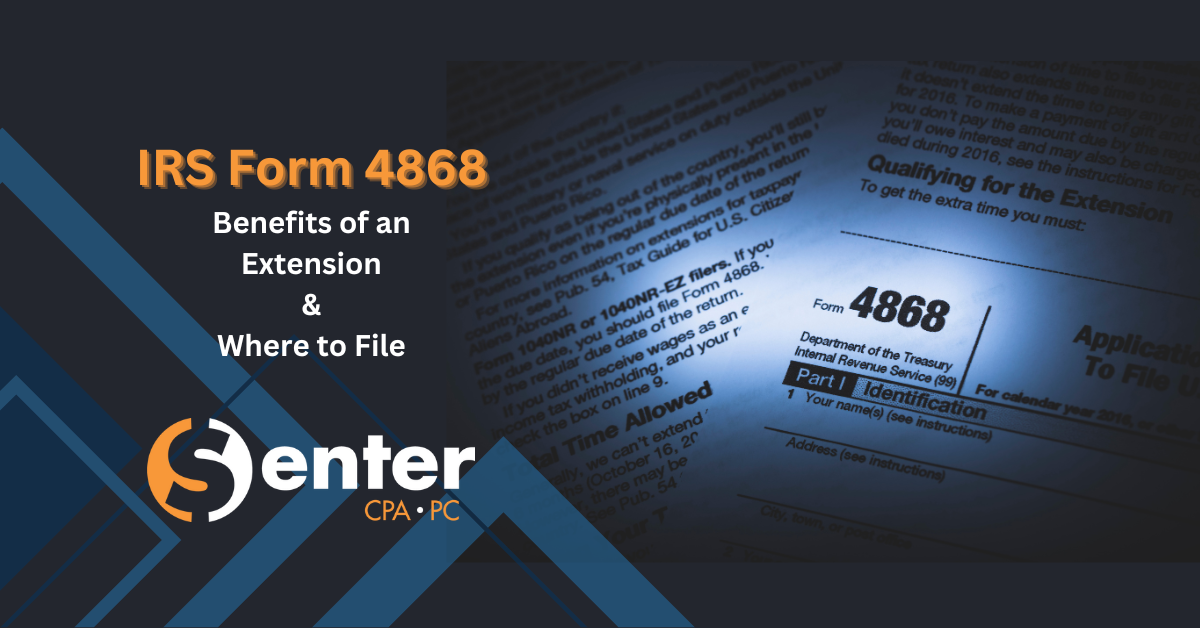

- October 16th

- Extended 2022 Personal tax returns are due

- December 31st

- Required minimum distributions must be taken for individual’s 73 or older by end of 2023

- January 15th

- Fourth quarter estimated tax payments are due