by Josh Legant | May 30, 2024 | Tax

The April 15th deadline is behind us. At this point, some of you may want to think about your 2024 finances and tax return. That being the case, for many of you, that would include taking a retirement distribution from your retirement accounts. If you think that you...

by Matthew Senter | May 15, 2024 | Accounting, Tax

Senter Forward: Elevating Your Business Accounting and Tax Compliance with Advisory Services Are you looking for more out of your CPA firm? Monthly Client Accounting Services, Advisory and Consulting services to help you understand your accounting and discuss tax...

by Matthew Senter | May 2, 2024 | Accounting, Tax

Dear Esteemed Clients & Friends, As we bid farewell to yet another tax season, we wanted to take a moment to express our deepest gratitude to each and every one of you. The past few months have been nothing short of extraordinary, and it’s all thanks to...

by Matthew Senter | Mar 20, 2024 | Tax

The Importance of Calculating and Taking Reasonable Compensation Wages for S Corporation Owners As a valued client of Senter CPA, it’s crucial to understand the significance of calculating and taking reasonable compensation wages, especially if you own an S...

by Josh Legant | Feb 28, 2024 | Tax

It is not uncommon to have a need for more time to prepare your federal tax return. This post provides valuable information on how to apply for an extension of time to file. Please be aware that: An extension of time to file your return does not grant you any...

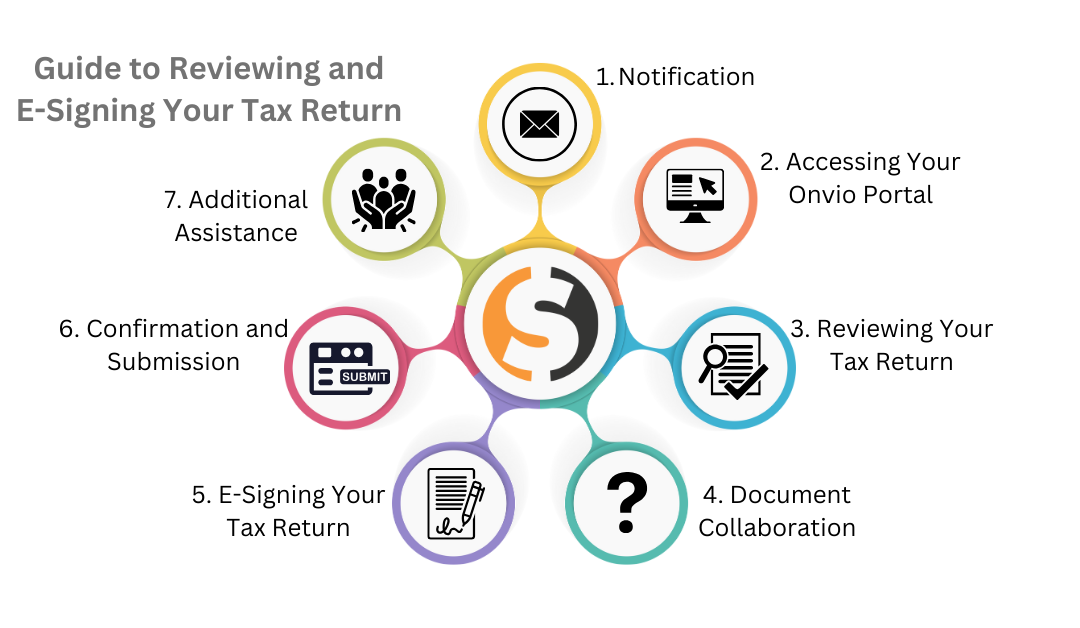

by Matthew Senter | Feb 16, 2024 | Tax

Senter CPA’s Guide to Reviewing and E-Signing Your Tax Return As tax season approaches, we understand the importance of making the process as smooth as possible for our clients. At Senter CPA, we leverage cutting-edge technology to simplify the review and e-signing of...