by Matthew Senter | Mar 27, 2025 | Accounting, Tax

As the tax filing deadline approaches, many taxpayers find themselves unprepared to submit their returns on time. In such cases, filing a tax extension can be a practical solution. This article clarifies what a tax extension entails, dispels common misconceptions, and...

by Matthew Senter | Mar 7, 2025 | Accounting, Tax

Making Your Federal & State Income Tax Payments (updated 2/16/25) Paying your federal and Michigan state income taxes has become more convenient with various online options. Here’s an updated guide to streamline your payment process: Federal Tax Payments...

by Matthew Senter | Mar 7, 2025 | Accounting, Tax

Understanding “Where’s My Refund?” for Your Federal and Michigan Tax Returns As tax season approaches, many taxpayers eagerly anticipate their refunds. At Senter CPA, we understand how important it is to track your refund status efficiently. That’s why...

by Matthew Senter | Feb 25, 2025 | Tax, Team

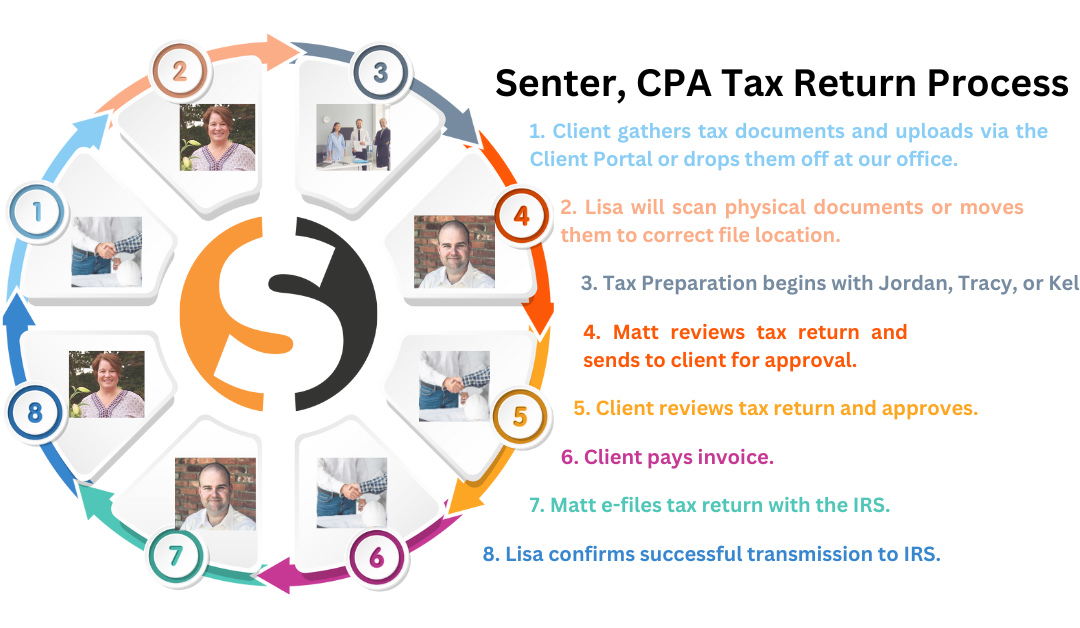

Tax Return Process At Senter, CPA, we strive to make your tax preparation process seamless and efficient. Here’s an overview of our updated tax return process for the 2025 tax season: (2024 tax returns) Step 1: Client gathers tax documents Complete your online...

by Matthew Senter | Feb 20, 2025 | Tax

As of February 20, 2025, the Beneficial Ownership Information (BOI) reporting requirements under the Corporate Transparency Act (CTA) have been reinstated. This follows the U.S. District Court for the Eastern District of Texas’s decision on February 18, 2025, to...

by Kelly Thompson | Feb 4, 2025 | Accounting, Tax

Utilizing ‘Rules’ in QuickBooks Online To lighten the load of reviewing and adding every single transaction, consider using the Rules tool. Doing so will potentially eliminate any miscoding and potentially, save you time. Purpose of the Rules Tool: The tool is...