by Matthew Senter | Sep 9, 2020 | Tax

Tax planning is the process of managing your financial plan with the goal of reducing your tax liability and safeguarding assets at the federal and state level. Most tax planning involves deductions, credits and current vs. future tax rates. When tax planning, you...

by Kylie Harig | Aug 11, 2020 | Internal Revenue Service, Tax

An IRS audit takes place when the Internal Revenue Service (IRS) chooses to investigate a taxpayer to ensure that tax laws are being followed. Filing your tax return entirely, accurately and truthfully will reduce the odds of being audited and increase the likelihood...

by Kylie Harig | Jun 30, 2020 | Accounting, Tax

The importance of establishing a strong working relationship with your CPA is crucial to feel comfortable trusting their guidance and relying on their advice. Having candid conversations on a regular basis will not only deepen your relationship with your accountant,...

by Matthew Senter | Jun 24, 2020 | Internal Revenue Service, Tax

Unsure how to make your upcoming estimated tax payment? Here’s how. Most folks don’t like to pay taxes, nor pay them quarterly, especially if they’re experiencing economic hardships due to COVID-19. However, you don’t want to end up paying...

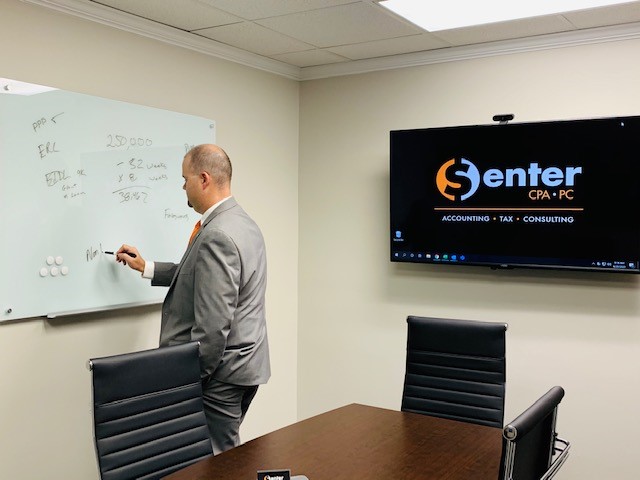

by Matthew Senter | Apr 12, 2020 | Accounting, Tax

Thinking about how to work with your accountant remotely? Senter, CPA was a virtual firm long before we needed to be due to the COVID-19 outbreak. From the beginning we’ve chosen high performance tools and technologies, which allow us to best service our...

by Kylie Harig | Mar 24, 2020 | Internal Revenue Service, Tax

Due to the COVID-19 outbreak and consistent with our expectations, the IRS released their notice on March 21 outlining the 90-day automatic extension for federal income tax filing and payments. This deferment applies to individuals, trusts, corporations and...