by Robin Scrace | Feb 23, 2022 | Courses, Internal Revenue Service, Tax

Did you know that you have the option to make your state and federal income tax payments online? You can pay your state and federal income tax online, by phone, or with your mobile device using the IRS2Go app. If you’re not sure where to go to make the payments,...

by Robin Scrace | Feb 14, 2022 | Community, Internal Revenue Service, Tax

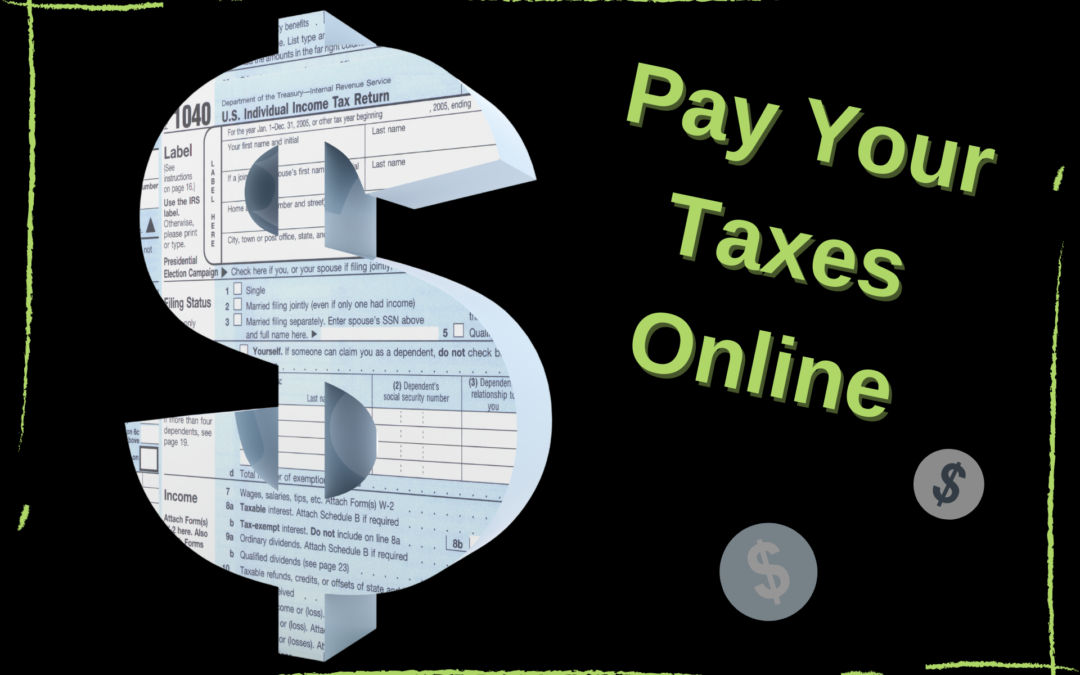

How Our Process Works Step 1: Contact Us Telephone: 248-934-0550 Use our online contact Form: HERE (or use the contact form below) Step 2: Upload Your Documents to Our Secure Portal A meeting isn’t required for us to prepare you taxes. Once you decide that...

by Matthew Senter | Jan 28, 2022 | Accounting, Community, Tax, Team

Hey folks! Want to stay up-to-date on all things Senter, CPA? Then we would like to personally invite you to subscribe to our monthly newsletter. Once a month we prepare and send a newsletter to our clients, friends and colleagues. Most of the content is drawn from...

by Rosemary Shamoon | Jan 26, 2022 | Tax

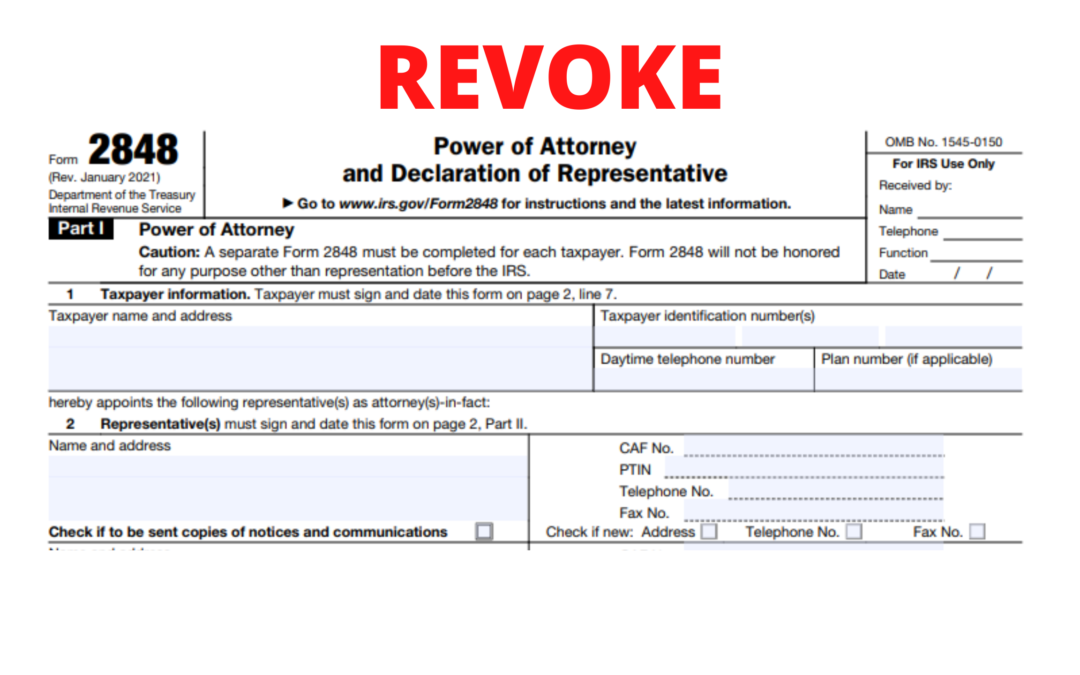

A power of attorney, or POA, is a legal document that gives another person the authority to make decisions on their behalf. POAs come in different forms, each suited for a specific purpose. Here we will look at 3 different types of POAs and explain why you may receive...

by Rosemary Shamoon | Dec 9, 2021 | Tax

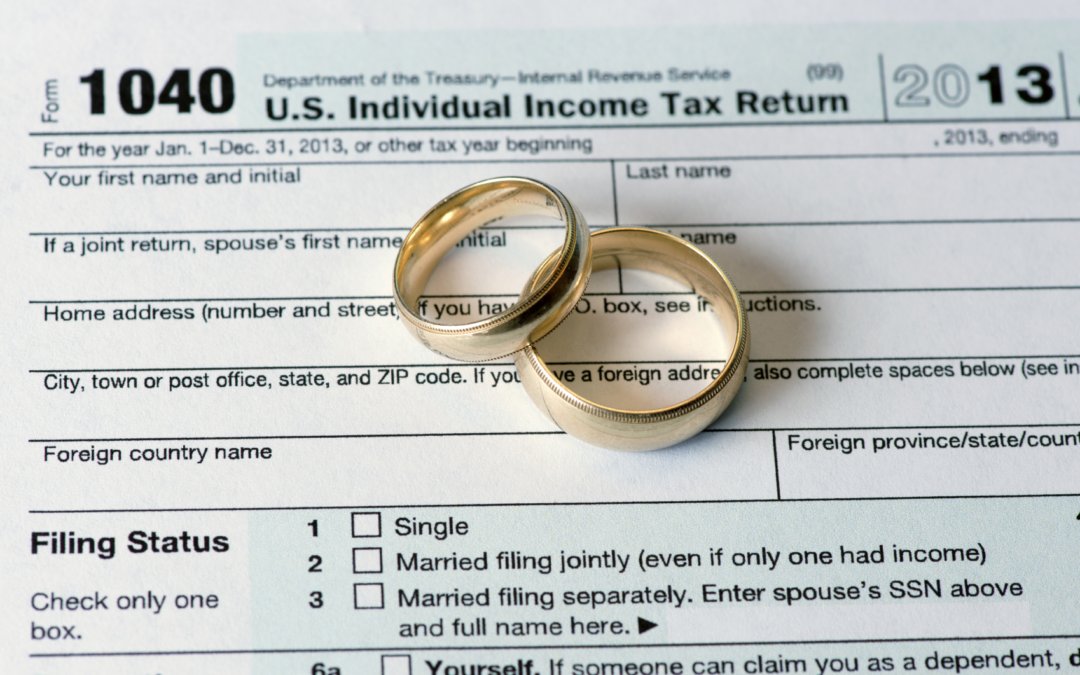

HOW DOES MARRIAGE AFFECT YOUR TAXES? Tax brackets are different for each filing status. When you get married and file a joint return, your income is combined with your spouse’s and may no longer be taxed at the same rate as when you were single. When you get...

by Matthew Senter | Nov 16, 2021 | Internal Revenue Service, Tax

In our last blog post we walked you through how to submit a Power of Attorney online. If you missed it, you can catch up here: Submitting Power of Attorneys and Tax Information Online But, what if you’re no longer satisfied with your current representative? Or,...