by Matthew Senter | Jan 23, 2026 | Accounting, Tax

Making Your Federal & State Income Tax Payments (updated January 2026) Paying federal and Michigan income taxes is pretty straightforward and are now required to be paid online. Below is the current list of ways to pay, plus a few tips to avoid mistakes and fees....

by Matthew Senter | Jan 7, 2026 | Accounting, Tax

Reflecting on 2025, Senter CPA has experienced significant growth and success, both personally and professionally. As we roll into 2026, we’re heading into our ninth year as a firm. That’s wild. It honestly feels like just yesterday that we unlocked the doors on...

by Jordan Middleton | Jan 7, 2026 | Accounting, Tax

Tax season is getting a serious tech upgrade. Thanks to a new executive order, the IRS is phasing out paper checks — both for refunds and payments, in favor of fully electronic transactions. Here’s a breakdown of what’s changing, why it matters, and how you can...

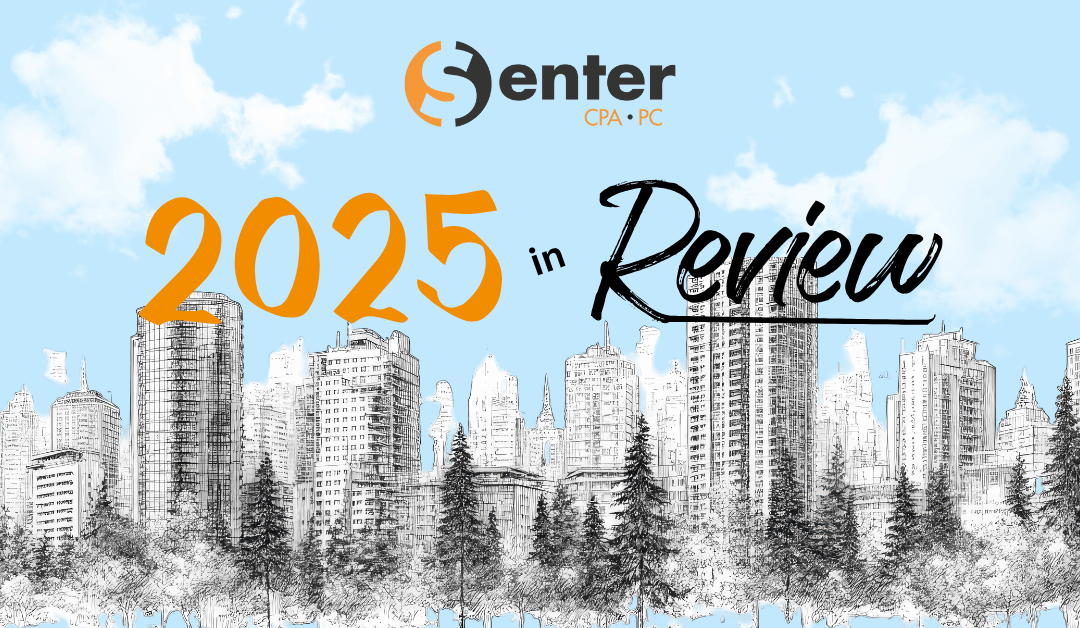

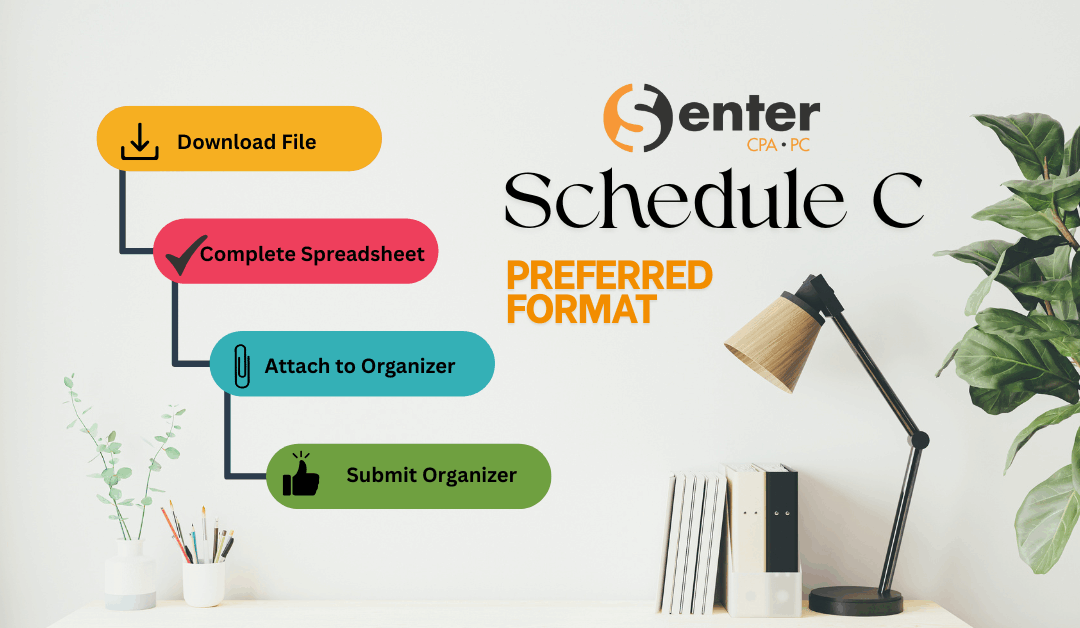

by Matthew Senter | Dec 23, 2025 | Accounting, Tax

If you file a Schedule C as a sole proprietor or single-member LLC, you already know how detailed the IRS can be. The Schedule C form requires a thorough breakdown of your business income and expenses, leaving little room for guesswork. Schedule C is the primary IRS...

by Matthew Senter | Dec 23, 2025 | Accounting, Tax

If you report rental income on a form Schedule E, you already know the IRS wants your numbers broken out by category and by property. The Schedule E form is the main IRS form used to report rental real estate income and expenses on your personal return, and clean...

by Matthew Senter | Dec 15, 2025 | Accounting, Tax

First off, thank you for being part of the Senter, CPA, P.C. family! Whether we helped untangle your taxes, guided your business through accounting complexities, or simply answered that one stubborn finance question that was bugging you, we hope we’ve made your...