Saving for retirement can be a daunting task. Here, at Senter CPA, we can help you make some of those retirement decisions. One of those being the decision to put money into a Traditional retirement account or a Roth account. Everyone has a different tax situation from year to year so there is no correct answer to which one is better.

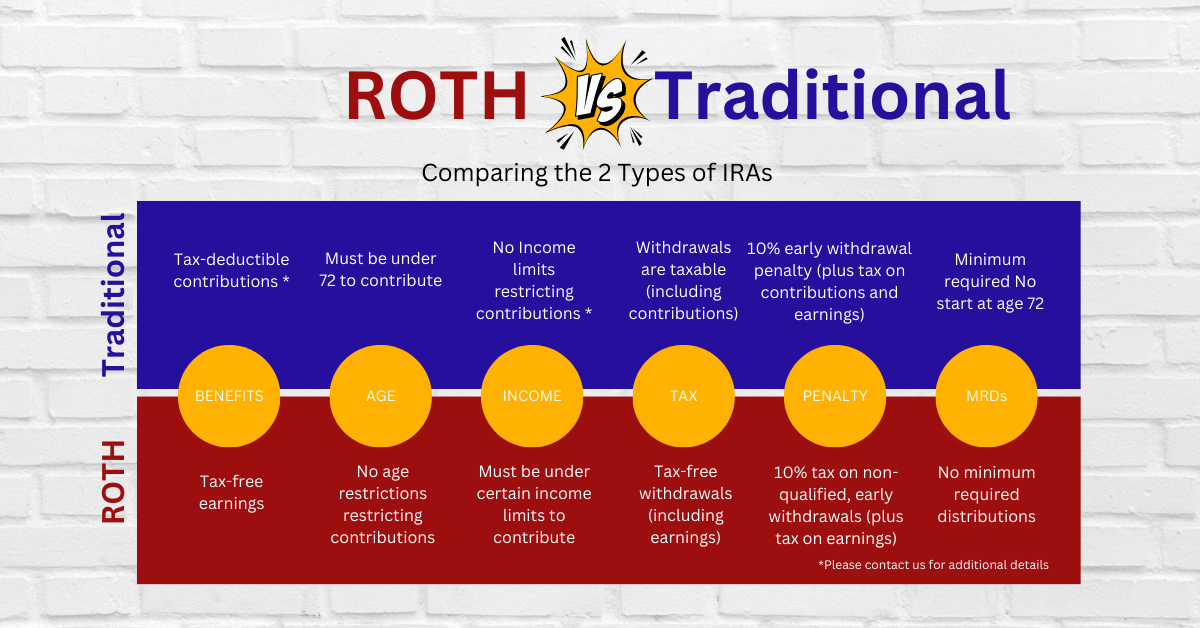

Traditional retirement is put into your account before you pay taxes on it. This helps lower your taxes due in the current year and allows your account to make a higher contribution. The negative of this type of account is that you will have to pay taxes on it when you pull the money out of the account. Traditional retirement accounts are also subject to RMD’s (required minimum distributions). This is a required distribution that starts when you turn 72.

Roth accounts have their contributions added after tax. This means there is no tax benefit in the current year, but the accounts will not be taxed again if you make qualified distributions. These accounts are not subject to RMD’s because they have already been taxed. So, the taxes are paid up front and the account grows tax free.

Now that you know the differences in the accounts, we will discuss some of the strategy applied to deciding. You will want to be taxed in the lowest tax brackets possible between the accounts. This means that if you are just starting your career and are in a lower tax bracket it could be a good time to contribute to a Roth account because you can get it into the account at a relatively lower tax rate. On the other hand, if you are having an amazing year and got raises and bonuses it might be a good year to contribute to a traditional account and have the tax benefit in the current year. This will allow you to pay taxes on that contribution later when you take a distribution when you are older and pssibly have a lower tax rate.

You have to look at these things from year to year. It’s not just a one-time thing. You might switch back and forth between the two or you might not be so certain about the future and want to split contributions into both so that you may have some flexibility when it comes to retirement planning. Other things to consider when thinking about retirement planning are that there are income limits to contributing to a Roth plan but there are ways to roll traditional accounts into Roths. If you have further questions about these, you can contact us or your financial advisors.