by Jordan Middleton | Jun 24, 2025 | Accounting, Tax

Accountants or Superheroes? Being honest, no one hears accounting and thinks “wow! that’s got to be fun!”. There are no explosions, no villains (except for maybe tax law), and definitely no fights (unless you count audits). But behind every successful business is a...

by Matthew Senter | Jun 11, 2025 | Accounting, Tax

Senter CPA is Moving to TaxDome: A Better Client Experience Starts Now At Senter CPA, P.C., we are always seeking new ways to deliver the highest quality service, communication, and security to our clients. As part of that mission, we’re excited to announce an...

by Matthew Senter | May 21, 2025 | Accounting, Tax

Dear Clarkston Community, As an affiliate of Dolly Parton’s Imagination Library, the Rotary Club of Clarkston is committed to creating a community that works for all children and all families, especially those most in need. Literacy is the foundation of a child’s...

by Tracy Sanda | May 21, 2025 | Accounting, Tax

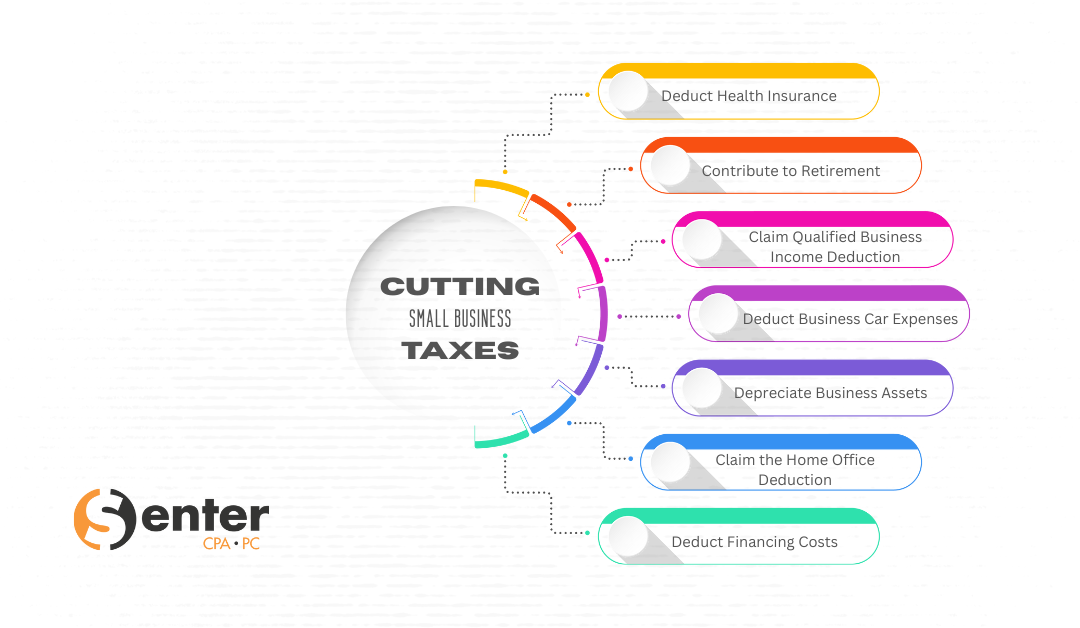

7 Effective Ways to Lower Your Tax Bill as a Small Business Owner Running a small business means balancing many tasks. While your primary focus is likely on day-to-day operations, it’s important to also consider strategies that can help reduce your tax burden. By...

by Matthew Senter | May 1, 2025 | Accounting, Tax

Wrapping Up Tax Season 2025: A Heartfelt Thank You Dear Valued Clients and Friends, As we close the books on another tax season, we want to pause and express our deepest appreciation for your continued trust and partnership. The 2025 season brought its own unique...

by Jordan Middleton | Apr 23, 2025 | Accounting, Tax

For the first time in the past three years, the IRS has set lower depreciation limits for passenger vehicles. These limits are updated annually for inflation. According to Rev. Proc. 2025-16, the depreciation limit for passenger vehicles eligible for Sec. 168(k)...