by Lisa Haiss | Feb 2, 2023 | Courses, Internal Revenue Service, Tax

Federal and State income tax payments can be made online. You can pay your state and federal income tax online, by phone, or with your mobile device using the IRS2Go app. Below are a list of links to make payments or to download the IRS2Go app. United States...

by Josh Legant | Dec 20, 2022 | Accounting, Courses, Internal Revenue Service, Tax

The end of the year is rapidly approaching. If you are wondering if it is necessary to issue 1099’s, then let us help you determine that. We have listed some common questions and answers related to 1099’s. What is a 1099? This is a form issued to a...

by Josh Legant | Nov 30, 2022 | Accounting, Courses, Internal Revenue Service, Tax

There are many people who may have question regarding the Employee Retention Credit (ERC) that became available for businesses during the Covid-19 pandemic. Below is a helpful article to decifer the facts about the ERC. As always, Senter, CPA is here to help. If you...

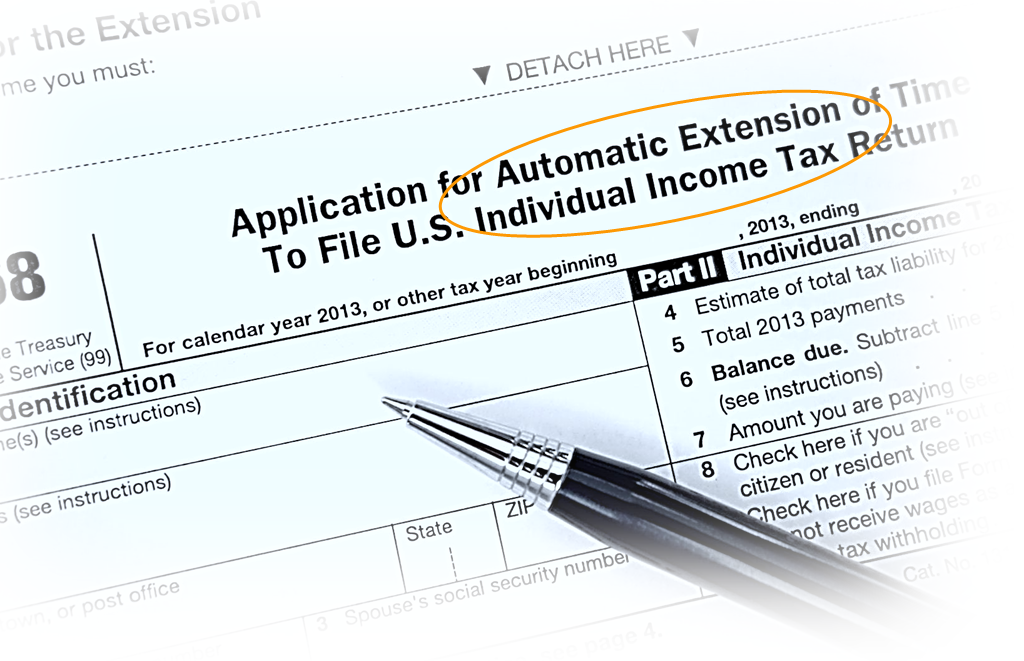

by Robin Scrace | Mar 25, 2022 | Internal Revenue Service, Tax

What Is a Tax Extension? A tax extension simply gives you extra time to file your taxes, six extra months to be exact. If you request an extension, it will be granted automatically, but the extension form 4868 must be filed no later than midnight on April 18th....

by Rosemary Shamoon | Mar 11, 2022 | Internal Revenue Service, Tax

Key Filing Dates There are several important dates taxpayers should keep in mind for this year’s filing season: January 14th IRS Free File opens. Taxpayers can begin filing returns through IRS Free File partners; tax returns will be transmitted to the IRS...

by Robin Scrace | Feb 23, 2022 | Courses, Internal Revenue Service, Tax

Did you know that you have the option to make your state and federal income tax payments online? You can pay your state and federal income tax online, by phone, or with your mobile device using the IRS2Go app. If you’re not sure where to go to make the payments,...